Retirement Pensions Are Our #1 Problem (and what you need to know about it)

“It’s not what we don’t know that hurts us, it’s what we know that ain’t so.”

—Will Rogers

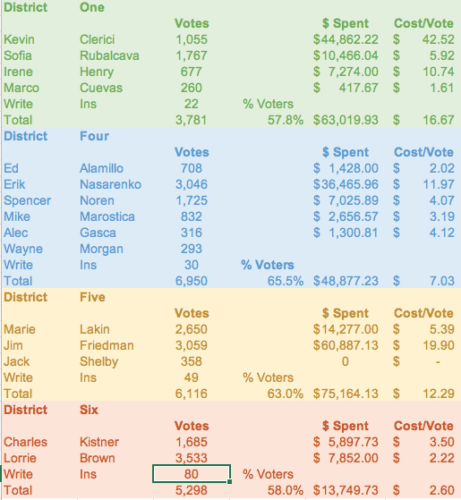

America’s significant retirement pension funds are underfunded by an unfathomable $4.2 Trillion, according to an August 6 Wall Street Journal article. Ventura mirrors this phenomenon. Ventura workers participate in the state pension fund, CalPERS—the largest in the country. CalPERS is only 71% funded as of June 30, 2018, despite a 10-year bull market and a growing economy.

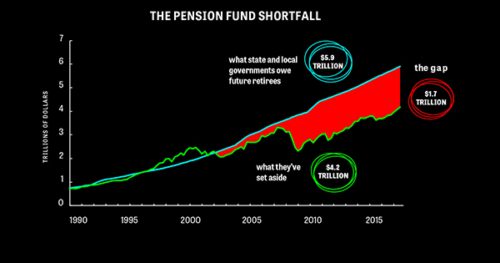

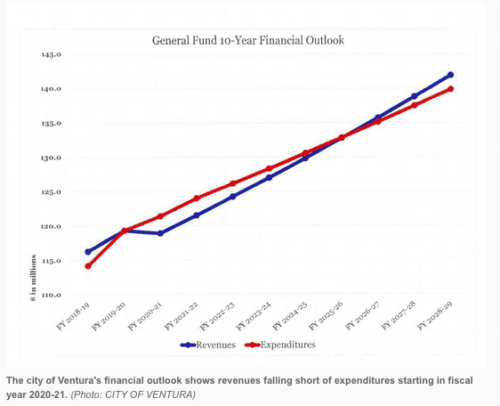

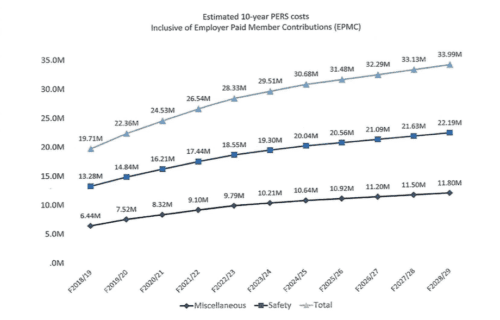

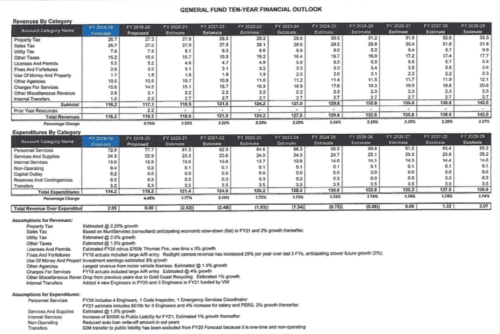

Because of the chronic funding shortfall, CalPERs demands rapidly increasing contributions from all participating local governments. Ventura will have permanent increases of at least $2 million per year for five to six consecutive years.

We respect the work city employees do. There is no denying that fire and police preform a vital job that is both dangerous and requires a high level of training and responsibility. Our concern is not about their work. It’s about the structure by which their retirement is accumulated and paid after retirement.

It is undeniable that city employees’ retirement pensions are crowding out the city’s ability to provide the service itself. Moreover, chronic underfunding of pensions will eventually hit a breaking point jeopardizing benefits too. Something in this equation has to change.

Retirement Pensions Today

Most state, county and local pension benefits are considered to carry a virtually iron-clad guarantee to the workers to whom they have been promised. Even the smallest attempts to alter future benefits—much less  current ones—have been met with furious opposition. Workers’ representatives and also the plan managers themselves—like CalPERS—oppose changes. That opposition has been mostly successful. Governments at all levels are hamstrung between their duties to provide on-going services to their citizens and their ever-increasing financial obligations to pension funds. In the State of California, once one hires an employee, their retirement cannot be changed.

current ones—have been met with furious opposition. Workers’ representatives and also the plan managers themselves—like CalPERS—oppose changes. That opposition has been mostly successful. Governments at all levels are hamstrung between their duties to provide on-going services to their citizens and their ever-increasing financial obligations to pension funds. In the State of California, once one hires an employee, their retirement cannot be changed.

A typical city employee would receive a pension almost the same as his or her working salary if they participated for their whole career. In the case of many public safety employees, their retirement will last longer than their employment as they are fully vested in their retirement pensions by age 50 or 55. For so-called “miscellaneous” employees (all others) the retirement age is higher, usually 62. Nevertheless, the years in retirement can still equal or exceed those worked.

Discussions about pensions get emotional because we’re talking about people’s future and security. What gets lost in the arguments is this. The law and politics guarantee retirement pension benefits, but not the actual returns on investments. There is no separate investment market for pension funds. All investment pools, large and small, invest in the same markets. The myth is that pensions are safe. They are not. The difference is that taxpayers pick up the difference between reality and what politicians promised.

Unprecedented Bull Market

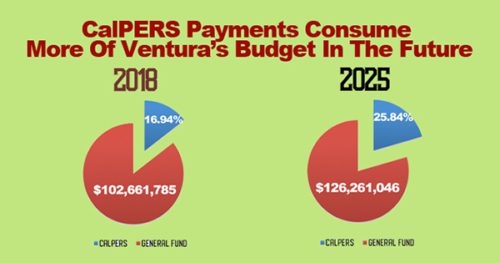

For the past ten years, since mid-2009, there has been an incredible bull market in stocks. CalPERS has posted many good returns during those years. However, Ventura’s pensions are underfunded by $215.1 million. For far too long, pension promises have been at levels far beyond what the real markets can provide.

What Can We Do To Fix Retirement Pensions?

Politicians have made many attempts to improve the current system, but none have addressed the problem in a meaningful way. CalPERS does offer one solution: Cities can buy out of the system—technically—but the costs are so enormous that no municipality can realistically consider that an option. It’s no accident, of course. CalPERS’ onerous payment demand to end participation is designed to be a straight-jacket. As of June 30, 2017, for the City of Ventura, the amount required to get out of CalPERS is $1.254 Billion.

League of California Cities and Government Finance Officers Association recommended actions to confront unsustainable pensions.

- Reduce the unfunded liability by making annual catch-up payment even more than CalPERS instructs you to pay—if you can afford to pay more.

- Raise taxes

- Reduce services

- Require voter approval of any pension obligation bond, or POB.

Pension Obligation Bonds Explained

A city issues a pension obligation bond to pay down the unfunded pension liability. The POB converts the pension liability into a fixed rate of return. There are considerable underwriting costs when issuing a POB. The city invests the money received from the bond into higher returning investments, usually in the stock market. The central idea is that the stock market investments will produce a higher return than the fixed interest rate on the bond, thereby earning money for the pension fund.

A POB creates debt to pay off debt. Such a bond is essentially a gamble with public money. Simi Valley is considering issuing a POB, and Ventura might follow suit if Simi Valley is successful.

The League of California Cities and Financial experts, including Government Finance Officers Association, strongly discourage local agencies from issuing Pension Obligation Bonds (POBs). This approach (going into debt to pay off debt) “only delays and compounds the inevitable financial impacts.”

These are terrible choices for the public.

What The City Council Might Do To Reform Retirement Pensions

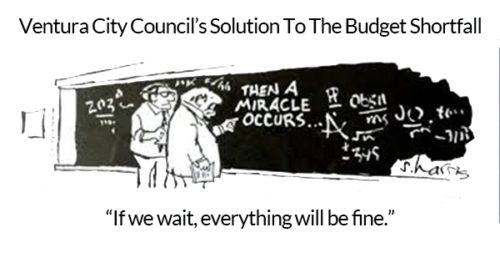

There are two other choices for our City Council to consider if they have the political will to do anything about this crisis that will cripple the City of Ventura.

There are two other choices for our City Council to consider if they have the political will to do anything about this crisis that will cripple the City of Ventura.

- Make beneficiaries pay more. With the city covering 100 percent of the unfunded liability, the problem will continue to grow. There will be minimal reforms because the actuarial losses fall on the taxpayer. Capping the employer contribution at a fixed percentage of salary would cut pension costs for the city. As pension costs increase over the years, the employees will pay all the costs associated with the growth.

- Change when retired city employees may begin collecting pensions. This alternative solution applies to new employees only. What if police and fire could fully vest their generous pensions by age 50 or 55, as they do now, but the payments did not start until age 65? Why would that help? The reason is that even if the city makes no further contributions, the fund will have ten more years to grow. At current official pension growth rates, that would more than double the value of that fund over those ten years. Also, the retirement payment period would be ten years shorter, given the same life expectancy. Such a system would still offer retirement security, but it would start at what most of us consider average retirement age.

Public sector employees may resist the changes but think about it. Private sector employees don’t get their full social security until 65 or even 67, depending the year they were born. Moreover, Social Security is only going to be one quarter to one-half of your working earnings.

Public sector employees may resist the changes but think about it. Private sector employees don’t get their full social security until 65 or even 67, depending the year they were born. Moreover, Social Security is only going to be one quarter to one-half of your working earnings.

Editor’s Comments

Even with an unprecedented bull market, Ventura’s unfunded pension liability grew over the past ten years. During such a period, one would expect the excess liability to at least shrink some.

Instead, the pension liability is growing faster than market returns can ever expect to make up. CalPERS annual demand will now permanently increase by about $2 million per year for the five to six years and then stay there. There is no assurance it will not increase even further in the future. Something has to change. Otherwise, the city will either cut back needed services, raise taxes, or both.

Past retirement pension negotiations were based on union bargaining and raw political power, creating a gap between what politicians promised and what cities realistically can pay. We offer some solutions, but it will take political will to bring the retirement benefits back to reality. Changing the system is the only way these promised benefits can be truly sustainable and dependable for retirees. It’s also the only way that taxpayers can afford to pay for them.

Demand Retirement Pension Reform

Below you’ll find the photos of our current City Council. Click on any Councilmember’s photo and you’ll open your email program ready to write directly to that Councilmember.

|

|

|

|

|

|

|

|

|

|

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

In an interview with Rachel Woodward, she revealed that she kept meticulous notes. She has a complete phone and paper trail of all dates and times that someone spoke to her, and a list of appointments and promises broken from representatives from City Hall. Rachel felt she needed to keep these records. She got the impression that everyone at City Hall was “very defensive,” and nobody wanted to be “held responsible” for what had occurred before the June 24th meeting.

In an interview with Rachel Woodward, she revealed that she kept meticulous notes. She has a complete phone and paper trail of all dates and times that someone spoke to her, and a list of appointments and promises broken from representatives from City Hall. Rachel felt she needed to keep these records. She got the impression that everyone at City Hall was “very defensive,” and nobody wanted to be “held responsible” for what had occurred before the June 24th meeting. Rachel further felt that it was also apparent that few, if anyone, was in the community visiting businesses. And, when someone visited a company, there weren’t clear directions on how to streamline the process.

Rachel further felt that it was also apparent that few, if anyone, was in the community visiting businesses. And, when someone visited a company, there weren’t clear directions on how to streamline the process.

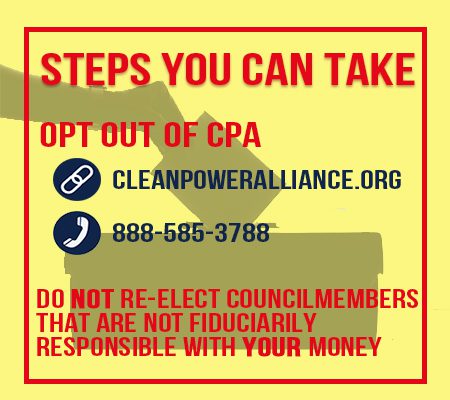

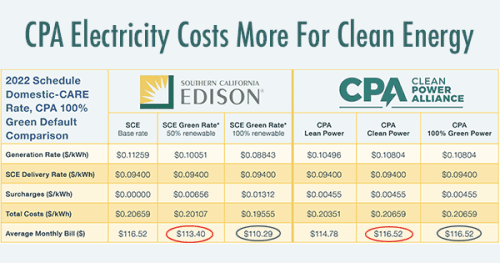

The Clean Power Alliance is a 2-year-old electricity provider in Southern California. They claim to bring clean, renewable energy at competitive rates. They compete with Southern California Edison (SCE), which has been around for 111 years and has been continually working on renewable energy for over ten years.

The Clean Power Alliance is a 2-year-old electricity provider in Southern California. They claim to bring clean, renewable energy at competitive rates. They compete with Southern California Edison (SCE), which has been around for 111 years and has been continually working on renewable energy for over ten years.

Councilman Jim Friedman got it right when he voted no. When he expressed that, “The budget is $3.5 million in the red now, and this just makes it worse.” By voting to pay more to the CPA—money the city does not have—city services will suffer. Your streets won’t get paved. The city doesn’t hire a police officer. Your water and wastewater rates increase. The police and fire departments don’t respond in time to save a life. If any of these things happen, you only need to look to four members of our City council for their budget decisions. (Mses. Heitmann, Weir, Brown and Rubalcava)

Councilman Jim Friedman got it right when he voted no. When he expressed that, “The budget is $3.5 million in the red now, and this just makes it worse.” By voting to pay more to the CPA—money the city does not have—city services will suffer. Your streets won’t get paved. The city doesn’t hire a police officer. Your water and wastewater rates increase. The police and fire departments don’t respond in time to save a life. If any of these things happen, you only need to look to four members of our City council for their budget decisions. (Mses. Heitmann, Weir, Brown and Rubalcava)

The City Council chose your electricity provider for you. In so doing, they shifted the burden of “Green Power” to every homeowner in the city. So, if you did not opt-out, you’ll pay higher electricity bills. We should resent the City Council forcing this upon the community. The CPA program should be a decision for each citizen to make. In this case, the government effectively enrolled everyone automatically without any consent from the citizens who will be paying the bill.

The City Council chose your electricity provider for you. In so doing, they shifted the burden of “Green Power” to every homeowner in the city. So, if you did not opt-out, you’ll pay higher electricity bills. We should resent the City Council forcing this upon the community. The CPA program should be a decision for each citizen to make. In this case, the government effectively enrolled everyone automatically without any consent from the citizens who will be paying the bill.

A second problem is how special interest groups lined up to get their share of Measure O. At the May 20th City Council meeting, Councilmembers Lorrie Brown, Jim Friedman and Mayor Matt LaVere tried to move funds from Measure O to the General Fund for Fire Station No. 4.

A second problem is how special interest groups lined up to get their share of Measure O. At the May 20th City Council meeting, Councilmembers Lorrie Brown, Jim Friedman and Mayor Matt LaVere tried to move funds from Measure O to the General Fund for Fire Station No. 4.  Economic disasters are all around us. There is no reason to think that Ventura is immune to them. The City of Oxnard is preparing to lay off hundreds of employees. They also plan to close a fire station and reduce the number of fire personnel available to respond to emergencies. The Oxnard City Manager says, “We are down to bare bones.” What’s happening in Oxnard is a preview of what could happen in Ventura unless the City Council acts quickly.

Economic disasters are all around us. There is no reason to think that Ventura is immune to them. The City of Oxnard is preparing to lay off hundreds of employees. They also plan to close a fire station and reduce the number of fire personnel available to respond to emergencies. The Oxnard City Manager says, “We are down to bare bones.” What’s happening in Oxnard is a preview of what could happen in Ventura unless the City Council acts quickly. The budgetary crisis is entirely avoidable if the City Council acts now. The solutions are simple, but they are not easy. It requires significant political will and resolve.

The budgetary crisis is entirely avoidable if the City Council acts now. The solutions are simple, but they are not easy. It requires significant political will and resolve.

Imagine the stimulus to the community of filling the old Star Free-Press building or the Toys-R-Us location would have.

Imagine the stimulus to the community of filling the old Star Free-Press building or the Toys-R-Us location would have. Any change to the Fire Department would likely be unpopular with the public. That makes it a subject considered by Councilmembers, to be too controversial to discuss. The fire department union will become protective of their fellow firefighters and will want to preserve the status quo.

Any change to the Fire Department would likely be unpopular with the public. That makes it a subject considered by Councilmembers, to be too controversial to discuss. The fire department union will become protective of their fellow firefighters and will want to preserve the status quo.

The Council has proposed some significant changes. They include:

The Council has proposed some significant changes. They include: Every Planning Commissioner would be accountable to the Councilmember who appointed him or her.

Every Planning Commissioner would be accountable to the Councilmember who appointed him or her. The proposed changes don’t please everyone. The immediate resistance came from some existing committee members and commissioners. There are two main objections. Some complained about the process. Others believe there will be less transparency and citizen involvement.

The proposed changes don’t please everyone. The immediate resistance came from some existing committee members and commissioners. There are two main objections. Some complained about the process. Others believe there will be less transparency and citizen involvement.

Topping the mayor’s list of priorities was opening a permanent, full-service homeless shelter by December 31, 2019. The date gives this goal specificity. Opening the center doesn’t begin to solve the problem, though. Mayor LaVere and the City Council equate opening a homeless center with improving Ventura’s homeless situation. They are not the same thing.

Topping the mayor’s list of priorities was opening a permanent, full-service homeless shelter by December 31, 2019. The date gives this goal specificity. Opening the center doesn’t begin to solve the problem, though. Mayor LaVere and the City Council equate opening a homeless center with improving Ventura’s homeless situation. They are not the same thing. What’s more, the City Council conflates opening the center with helping the homeless. The goal shouldn’t be to have beds available. That’s an intermediary step. The goal should be to get the homeless off the street and return them to a healthy way of life.

What’s more, the City Council conflates opening the center with helping the homeless. The goal shouldn’t be to have beds available. That’s an intermediary step. The goal should be to get the homeless off the street and return them to a healthy way of life.

Mayor LaVere’s fourth goal is to beautify the community. He wants to end what he termed “blight.”

Mayor LaVere’s fourth goal is to beautify the community. He wants to end what he termed “blight.” The mayor hopes to achieve this goal by building community parks. The Westside Community Park set the model. Mayor LaVere’s first target is Mission Park.

The mayor hopes to achieve this goal by building community parks. The Westside Community Park set the model. Mayor LaVere’s first target is Mission Park. Mission Park is home to a growing number of Ventura’s homeless population. To prepare the area, the homeless must move elsewhere. The 55-bed homeless shelter isn’t the solution. Also, even if we scatter the homeless, there are safety issues. Someone would have to clean the discarded needles, drug paraphernalia and human waste from the park.

Mission Park is home to a growing number of Ventura’s homeless population. To prepare the area, the homeless must move elsewhere. The 55-bed homeless shelter isn’t the solution. Also, even if we scatter the homeless, there are safety issues. Someone would have to clean the discarded needles, drug paraphernalia and human waste from the park. The need for key personnel is a huge problem. To fulfill any of our mayor’s goals requires adequate staff. The final 2019-2020 goal is to stabilize and strengthen our city government. The city has eight unfilled, critical managerial positions and dozens of vacant jobs. The city will achieve none of the other ambitious goals if there aren’t enough workers at City Hall.

The need for key personnel is a huge problem. To fulfill any of our mayor’s goals requires adequate staff. The final 2019-2020 goal is to stabilize and strengthen our city government. The city has eight unfilled, critical managerial positions and dozens of vacant jobs. The city will achieve none of the other ambitious goals if there aren’t enough workers at City Hall.

Costing over $500,000,000 is not the only issue. The more significant issue is that the City Council assumed DPR water was safe to drink.

Costing over $500,000,000 is not the only issue. The more significant issue is that the City Council assumed DPR water was safe to drink.  However, the Consent Decree says the court can extend the time limit in the event of construction constraints, financing problems, or an emergency. It requires Ventura to petition the court requesting an extension, or an agreement with the plaintiff and their lawyers. That has not happened.

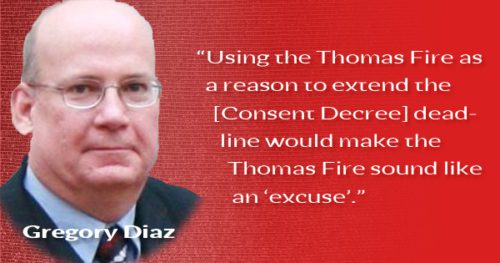

However, the Consent Decree says the court can extend the time limit in the event of construction constraints, financing problems, or an emergency. It requires Ventura to petition the court requesting an extension, or an agreement with the plaintiff and their lawyers. That has not happened. On February 4, 2019, Council Member Jim Friedman asked our City Attorney, Gregory Diaz about extending the deadline.

On February 4, 2019, Council Member Jim Friedman asked our City Attorney, Gregory Diaz about extending the deadline.

Ventura Water forces the City Council to get their information from the General Manager. Thus bypassing the entire reason the city established the Water Commission.

Ventura Water forces the City Council to get their information from the General Manager. Thus bypassing the entire reason the city established the Water Commission. You may not have heard about the incident. It’s not because Ventura Water didn’t announce it. They did. Ventura Water fulfilled the letter of the law, but it may have missed the intent behind it. Meeting the legal requirement seems to be the minimum standard. Yet setting the bar at the lowest level may place everyone’s health at risk in the future.

You may not have heard about the incident. It’s not because Ventura Water didn’t announce it. They did. Ventura Water fulfilled the letter of the law, but it may have missed the intent behind it. Meeting the legal requirement seems to be the minimum standard. Yet setting the bar at the lowest level may place everyone’s health at risk in the future. In July, Ventura Water withheld information from the Water Commission. A panel of experts examined

In July, Ventura Water withheld information from the Water Commission. A panel of experts examined

The City Council waffles on second-story height restrictions for

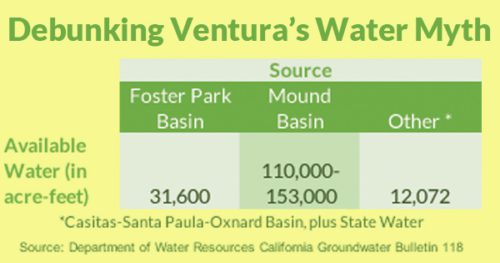

The City Council waffles on second-story height restrictions for  The City Council instructs Ventura Water to focus on connecting to State Water

The City Council instructs Ventura Water to focus on connecting to State Water