It Was The Best And Worst Of Times For Ventura In 2018

“Those who fail to learn from history are condemned to repeat it.”— Winston Churchill

Last year was a most transformational year in Ventura’s history. Every aspect of life in Ventura was affected. The city was in the national spotlight, twice. Leadership changed but at a high price. Old ways of doing business didn’t change, though. Overall, it was a year to remember.

December 2017

To understand 2018, you must appreciate December 2017 and the Thomas Fire. The fire destroyed 535 houses in Ventura. The city was the epicenter of the national news.

Thirteen months later, Ventura had the opportunity for the most significant economic stimulus since the oil boom but failed to capitalize on it. Rebuilding the homes will stimulate the local economy by $350 million. The only thing standing in the way of that economic windfall is the city.

What are the lessons we learned from the Thomas Fire? Good question. Thirteen months later we still don’t know that answer. The city has yet to produce a report on its findings. [Read More]

January 2018

The Montecito mudslides closed off transportation into and out of Santa Barbara along the 101. Many Venturans that work in Santa Barbara were unable to commute.

March 2018

The City Council waffles on second-story height restrictions for rebuilding Thomas Fire victims’ homes, delaying the rebuilding process and adding costs for many. [Read More]

The City Council waffles on second-story height restrictions for rebuilding Thomas Fire victims’ homes, delaying the rebuilding process and adding costs for many. [Read More]

April 2018

Jamal Jackson slays Anthony Mele, Jr. on Ventura’s promenade. Once again, the city was thrust into the national news.

Ventura Police increased patrols along the promenade. The City Council approved funds to continue the patrols. Arrests increased after the incident.

Post-incident, the Police department reviewed its procedures. There have been changes to the security camera monitoring as a result. The review also concluded the call was not improperly prioritized when it came in two and a half hours before the murder.

Since May, the community has returned to business as usual. [Read More]

June 2018

Ventura Police officers sign a new contract with a 5% pay increase. The timing of the announcement was questionable, but the contract was a fair one. [Read More]

July 2018

The City Council instructs Ventura Water to focus on connecting to State Water over Direct Potable Reuse (DPR). DPR takes recycled wastewater and injects it back into the drinking supply.

The City Council instructs Ventura Water to focus on connecting to State Water over Direct Potable Reuse (DPR). DPR takes recycled wastewater and injects it back into the drinking supply.

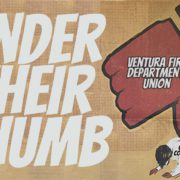

The City Council approves a $600,000 per year “roving” fire engine and three paramedics over the objections of Interim City Manager Dan Paranick. Ventura Fire hired two of the three paramedics before the Council approved the funding. [Read More]

September 2018

Ventura Water hires eight new positions. The City Council approved the department’s budget that included these positions. Ventura Water based that budget on Direct Potable Reuse (DPR) projects being the city’s top priority. When the Council realigned Ventura Water’s priorities in July, the department didn’t adjust its manpower requirements.

October 2018

Ventura Water begins installing new digital water meters. It is a $9 million project that will take three years to complete. The new meters allow more precise leak protection. The new meters also measure water usage more precisely. You can expect your water bill to be more accurate, too.

November 2018

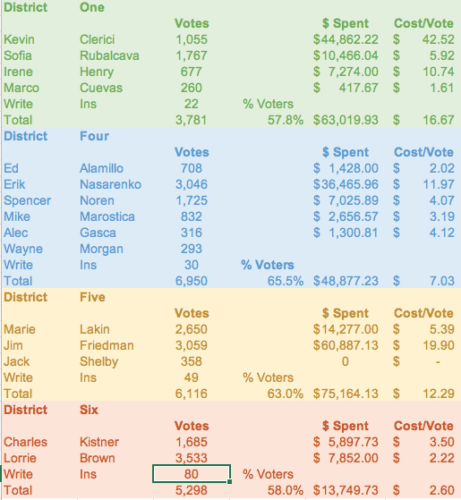

Ventura held its first City Council elections by voting district. Lorrie Brown (District 6), Jim Friedman (District 5), Erik Nasarenko (District 4) and Sofia Rubalcava (District 1) won. The candidates raised a record amount of money, despite campaigning in districts instead of citywide. The cost-per-vote skyrocketed to win a seat from $2.75 per vote in the last election with an open position to a record-high $26.42. [Read More]

December 2018

Alex McIntyre starts as City Manager. He replaces Mark Watkins who resigned in November 2017. The city had operated with an interim-City Manager since January 2018. McIntyre comes to Ventura from Menlo Park where he was City Manager for six years.

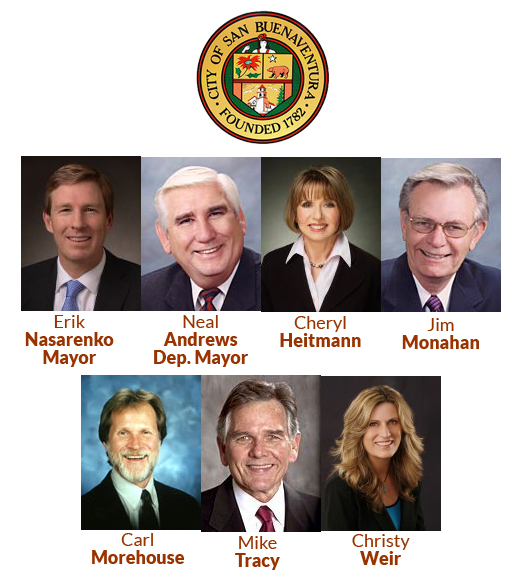

Ventura’s new City Councilmembers are sworn in. The Council has four female members: Lorrie Brown (District 6), Cheryl Heitmann (District 7), Sofia Rubalcava (District 1) and Christy Weir (District 2). Ventura has its first female-majority City Council in history. It’s also the most diverse set of Councilmembers the city has ever had.

Wish The Councilmembers Good Luck In 2019

Below you’ll find the photos of our current City Council. Click on any Councilmember’s photo and you’ll open your email program ready to write directly to that Councilmember.

|

|

|

|

|

|

|

|

|

|

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

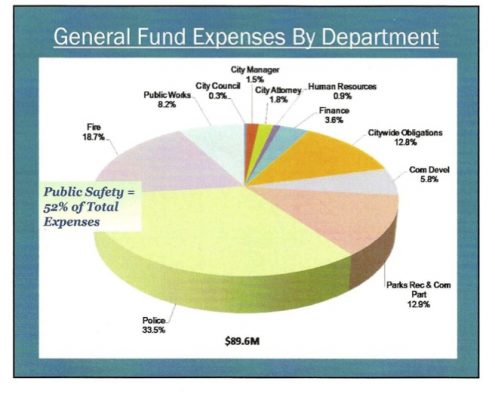

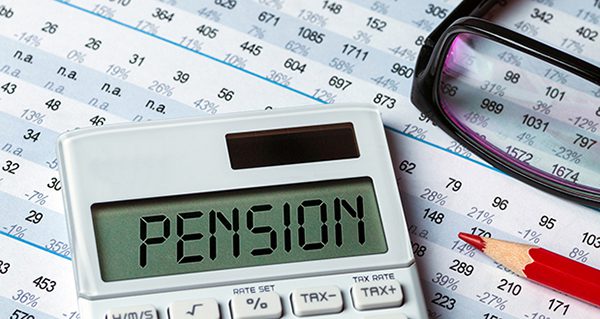

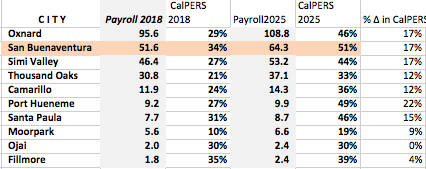

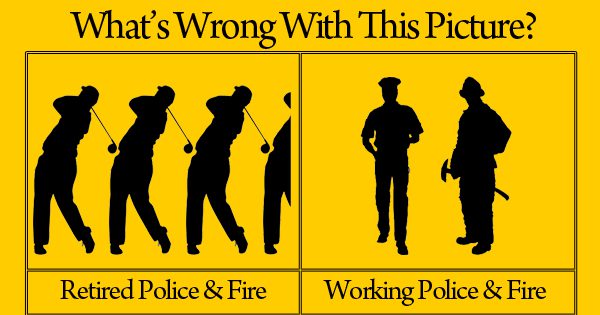

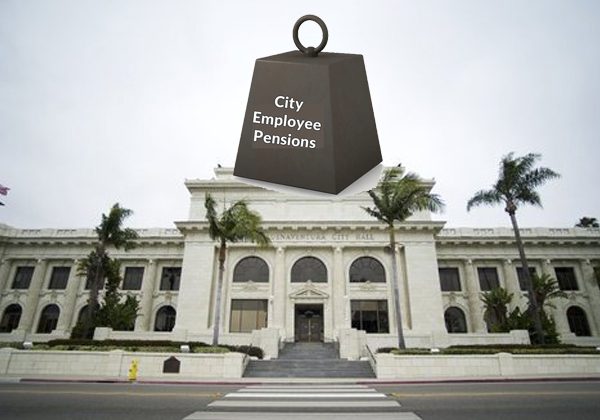

Ventura is already paying 34 cents to CalPERS for every dollar it pays its active employees. In six years, that amount will go up to an unsustainable 51 cents for every dollar of payroll—more than any city in Ventura County. Pensions are already crowding out other essential city services like filling potholes, fixing infrastructure and even hiring more police officers and firefighters.

Ventura is already paying 34 cents to CalPERS for every dollar it pays its active employees. In six years, that amount will go up to an unsustainable 51 cents for every dollar of payroll—more than any city in Ventura County. Pensions are already crowding out other essential city services like filling potholes, fixing infrastructure and even hiring more police officers and firefighters.

This November, Ventura has an unprecedented opportunity to tell the City Council, “No more new spending.” There are three open seats on the Council in this November’s election.

This November, Ventura has an unprecedented opportunity to tell the City Council, “No more new spending.” There are three open seats on the Council in this November’s election.

Fool me once, shame on you. Fool me twice, shame on me.

Fool me once, shame on you. Fool me twice, shame on me.