The Looming Catastrophe of Unfunded Pension Liabilities in Ventura

“IT ISN’T WHAT WE DON’T KNOW THAT GIVES US TROUBLE, IT’S WHAT WE KNOW THAT AIN’T SO”

—Will Rodgers

NEGLECTING THE UNFUNDED PENSION CRISIS DOESN’T MAKE IT DISAPPEAR

For eight years Ventura has done little to remedy the unfunded pension liability. During that time, there have been three different City Councils. Yet they made only a modest effort to solve the problem. They got employees to agree to contribute toward their own retirement. Meanwhile, those same City Councils have exacerbated the problem. They granted large raises to public safety and SEIU employees. This is a case of ‘too little, too late’.

Eight years ago, we pointed out the amount of pension benefits Ventura owed. We owe these benefits to retired city employees and those about to retire. We owed $150,000,000 of unfunded liability. Two major pension plans account for the entire liability—Public Safety and Miscellaneous. The Public Safety pension plan covers police and fire retirees. The Miscellaneous pension plan covers all other employees.

The Ventura County Star reported the deplorable condition of Ventura’s pension plans. And, the Grand Jury labeled the plans as “out of control.”

The office of the City Manager tells us that they have everything under control. And, in 5 years things will level out. There are no records or calculations offered to support that statement.

STILL LIVING FAR BEYOND OUR MEANS

CalPERS sticks Ventura with rising unfunded pension liability costs.

The problem is simple. Ventura has not set aside enough money to pay for future benefits to city employees when they retire. What’s more, the California Pension System (CalPERS) let Ventura down. It did not earn enough return on investment on the money Ventura paid into the fund.

Since 2008, the situation has gotten far worse. In the last CalPERS report published in 2016, the city’s unfunded liability totaled $169,292,212. In other words, the liability we owe grew 12.9% in eight years.

ONE CITIZEN’S ANALYSIS

The City Manager and City Council knew of this UAL increase before they campaigned for Measure O.

Proceeds from Measure O will be more than $11 million a year for the next 25 years. It may not be enough to cover the debt, though.

CalPERS recently published the projected pension costs for the City of Ventura. Taxpayers are 100 percent responsible for paying these foreseeable costs.

The CalPERS Circular Letter Dated January 19, 2017 contained these facts:

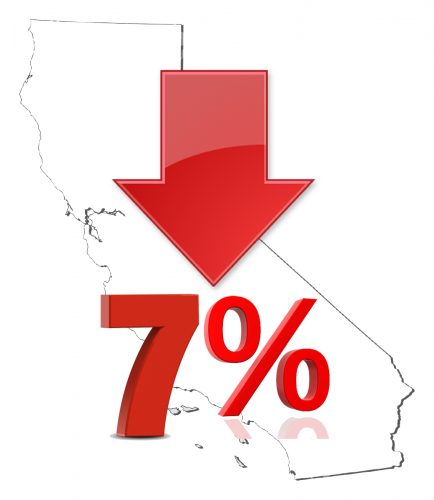

CalPERS lowers its rate of return on investments to 7% impacting Ventura’s unfunded pension liabilities.

The CalPERS Board of Administration approved lowering the CalPERS discount rate on December 21, 2016.

The long-term rate of return will now be 7.00 percent over the next three years. This will increase public agency employer contribution costs beginning in Fiscal Year 2018-19.

For the years 2017 to 2023, CalPERS actuary reports show increases to the annual Unamortized Actuarial Liability (UAL). These costs will increase 91 percent or $8.8 million.

In the CalPERS Circular Letter dated 1/19/17, the assumed return rate decreased to 7 percent from 7.5 percent. Ventura will pay an extra $3.7 million from FY 2016-17 to FY 2022-23.

Combined, the city’s annual UAL cost will increase $12.5 million to $22.2 million over the next six years.

No other expense or revenue (tax) item will increase that fast. Left unaddressed, these increased costs may force the city to curtail basic services.

EDITORS’ COMMENTS:

Increasing revenue or reducing expenses solves most budget problems. For Ventura, increasing revenue means more sales taxes and property taxes. And reducing expenses means service cut backs or layoffs.

Increasing revenues and cutting expenses seems like the obvious fix. Yet, a less popular third option is available. The employees must contribute more toward their own retirement. After all, they will benefit the most from these pensions.

Ventura’s long-term solution will be a combination of all three choices. Increasing revenues and reducing expenses with higher employee contributions is the right prescription.

FEEL STRONGLY ABOUT THIS? WRITE YOUR COUNCILMEMBER.

Click on the photo of a Councilmember to send him or her a direct email.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Leave a Reply

Want to join the discussion?Feel free to contribute!