“Do not suffer your good nature…to say yes when you ought to say no.”

—George Washington

As the 21st century teeters between the 2010s and the 2020s, it’s a perfect time to take stock of an eventful decade. Over the last ten years, several key events changed Ventura forever. Let’s look at what happened and the effect these incidents had.

How We’ll Remember The 2010s

We’ll remember the 2010s as a decade that began with the city struggling to get out of a recession, followed by ten years of decisions made with good intentions gone wrong. Bureaucrats and politicians pushed their agendas on the city. And like Sisyphus pushing the boulder up the hill, we kept falling backward.

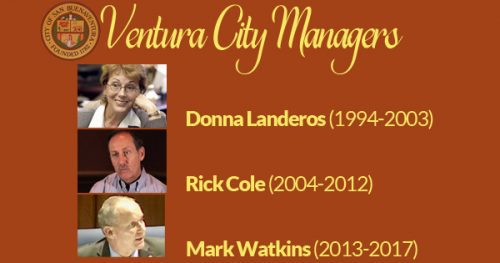

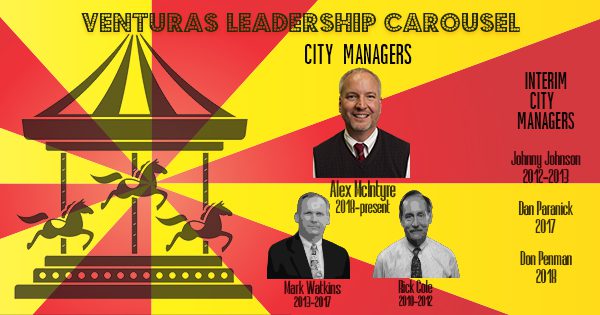

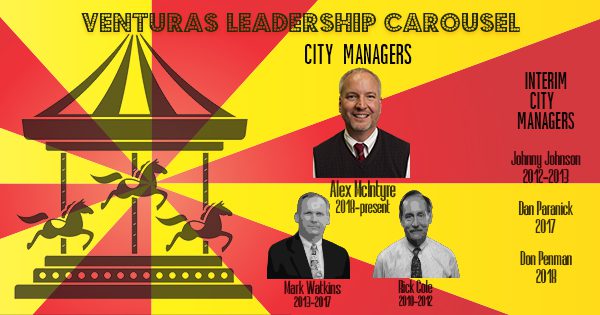

It’s remarkable that the city accomplished anything in the 2010s. We had three City Managers and three Interim City Managers. No one person was in the role for more than three years. Turnover created a leadership vacuum that minimized any chance for meaningful change.

It’s remarkable that the city accomplished anything in the 2010s. We had three City Managers and three Interim City Managers. No one person was in the role for more than three years. Turnover created a leadership vacuum that minimized any chance for meaningful change.

Key Events In The Decade Of The 2010s

The 2010s started as “business as usual.” Then the Thomas Fire happened. Citizens quickly became interested in how the Ventura would handle two issues: public safety during and after the fire, and rebuilding. After twelve months of intense interest, citizens have returned to “business as usual.”

Here are the key events of the decade: the Thomas Fire, December 2017; the Wishtoyo Consent Decree, 2012; Pension Inflation, 2010-2019; Homelessness, 2010-2019; the Anthony Mele, Jr. murder, April 2018; Brooks Institute’s failure, 2016; the WAV Building, 2012; Ventura’s Grand Jury Finding against Ventura’s building & safety inspectors, 2013; and district elections. Let’s look at what happened in each case and how it affects you.

The Thomas Fire

The biggest misfortune in Ventura’s history was the Thomas Fire, which began on December 4, 2017. The fire destroyed 535 structures in the city, displacing hundreds of residents and impacting everyone’s lives.

During the fire, Ventura’s public safety performed admirably. Despite the widespread devastation, police and fire protected the lives of everyone living in the city. Evacuations were orderly, albeit slow. There were many stories of heroic efforts by police and fire going beyond the call of duty.

Other aspects of the city’s performance didn’t go so well. Several groups pilloried Ventura Water for inadequate water supply to fire hydrants in the affected areas. An investigation is on-going. So are lawsuits.

The City Council added to the misery of the victims in an example of good intentions gone bad. The Council waffled on second-story height restrictions for rebuilding victims’ homes. Indecisiveness delayed the rebuilding process for many. They attempted to please fire victims wanting to improve their homes and doing so delayed rebuilding for everyone.

After two years, only 80 families have returned to their rebuilt homes.

The Wishtoyo Consent Decree

The Consent Decree stems from a federal complaint filed by Whistoya Foundation [WISHTOYA VS. CITY OF SAN BUENAVENTURA, CASE NO. CV 10-02072]. The Consent Decree requires Ventura to stop putting 100% of its treated wastewater into the Santa Clara River estuary. The city must divert a percentage of the 7.5 million gallons-per-day starting in 2025. The balance must be redirected by 2030. That decree is silent on how and where Ventura diverts the wastewater.

The Consent Decree stems from a federal complaint filed by Whistoya Foundation [WISHTOYA VS. CITY OF SAN BUENAVENTURA, CASE NO. CV 10-02072]. The Consent Decree requires Ventura to stop putting 100% of its treated wastewater into the Santa Clara River estuary. The city must divert a percentage of the 7.5 million gallons-per-day starting in 2025. The balance must be redirected by 2030. That decree is silent on how and where Ventura diverts the wastewater.

Ventura Water seized the opportunity to make the city the first to use recycled wastewater for drinking. Ventura Water calls the project VenturaWaterPure. No cities in the world have used recycled water except Windhoek, Namibia and a small town in Texas. Neither place had other water options.

Ventura Water has confused the City Council by combining two different ideas to falsely heighten the urgency to drink wastewater.

VenturaWaterPure will cost $1 billion over 30 years. That’s a considerable sum of money for the community to absorb. Expect your water bill to double to pay for VenturaWaterPure’s infrastructure alone. Remember, water costs already went up by $220 million with water and wastewater increases in 2012-13.

The Wishtoyo Consent Decree is a fiscal calamity for the city. More cost-effective options exist, but the City Council and Ventura Water fail to consider them. Times change. Circumstances change. Now is the time to reconsider options to be sure we’re making the best choice available.

Pension Inflation Throughout The 2010s

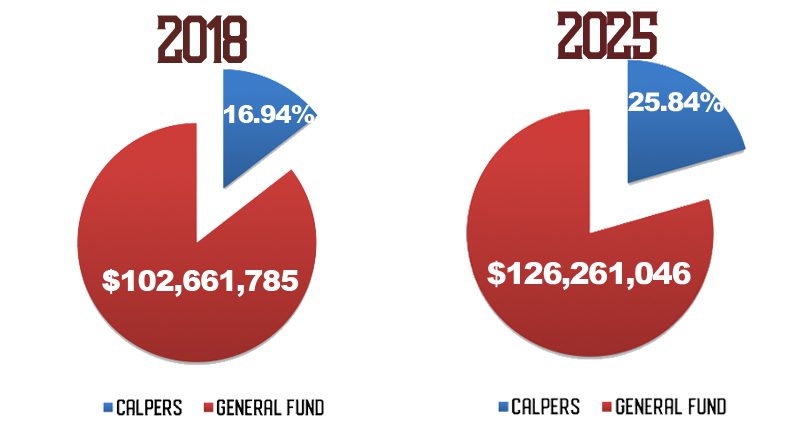

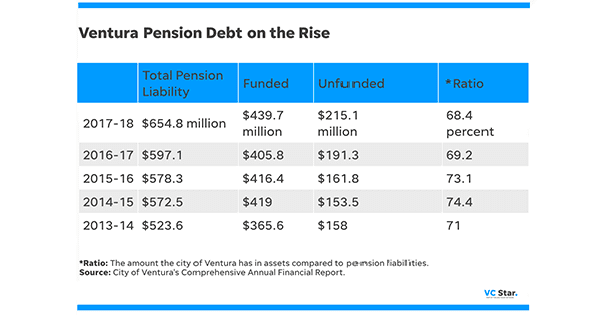

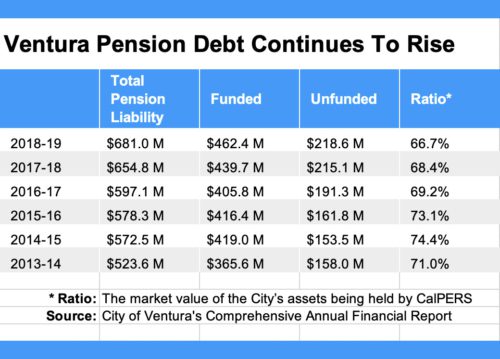

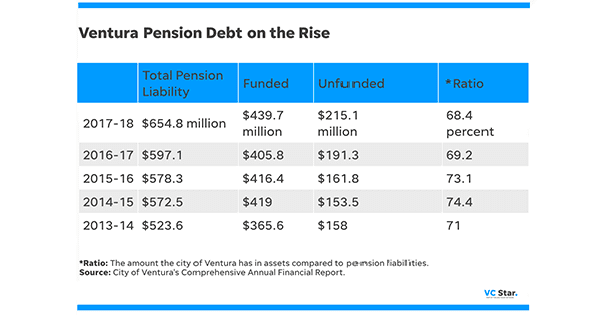

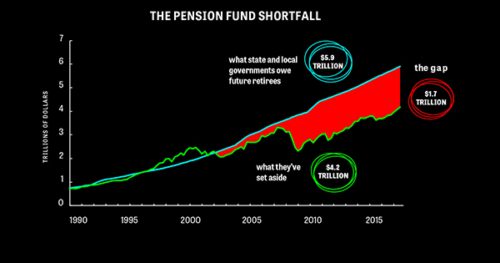

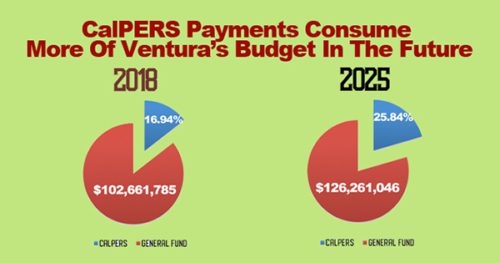

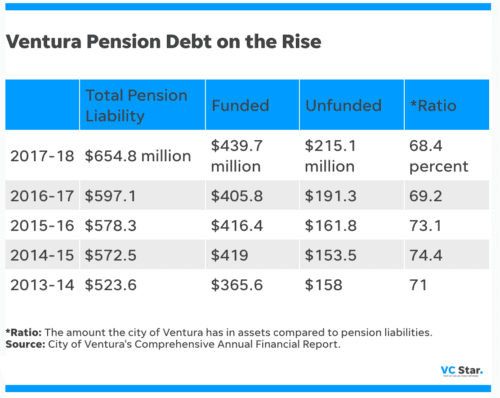

Retirement pensions are the city’s number one problem.  Ventura currently has a $215.1 million unfunded pension liability, and that number continues to grow. CalPERS (the California Public Employees retirement fund) demands rapidly increasing contributions from Ventura. We will have permanent increases of at least $2 million per year for five to six consecutive years.

Ventura currently has a $215.1 million unfunded pension liability, and that number continues to grow. CalPERS (the California Public Employees retirement fund) demands rapidly increasing contributions from Ventura. We will have permanent increases of at least $2 million per year for five to six consecutive years.

We respect the work city employees do. There is no denying that fire and police preform a vital job that is both dangerous and requires a high level of training and responsibility. Our concern is not about their work. It’s about the structure by which their retirement is accumulated and paid after retirement.

It is undeniable that city employees’ retirement pensions are crowding out the city’s ability to provide the service itself. Moreover, chronic underfunding of pensions will eventually hit a breaking point jeopardizing the employees’ benefits too. Expect your taxes to increase (á la Measure O) and the services the city provides to decrease.

Homelessness In Ventura In The 2010s

You may remember Dwight D. Eisenhower’s Farewell Speech when he described the Military-Industrial Complex. Now, we have something new, the Homelessness-Industrial Complex. Today’s Homelessness-Industrial Complex shares some of the same characteristics as the Military-Industrial Complex. There is an alliance of special interests. It includes government bureaucracies, homeless advocacy groups operating through nonprofit entities, and large government contractors, especially construction companies and land development firms.

Here’s how the process works: Developers accept public money to build projects to house the homeless – either “bridge housing,” or “permanent supportive housing.” Cities and counties collect building fees and hire bureaucrats for oversight. The projects are then handed off to nonprofits with long term contracts to run them.

Sounds good, right? That is until you see the price tag. Developers don’t just build housing projects; they construct ridiculously overpriced, overbuilt housing projects. (Keep in mind Ventura’s permitting fees and stringent building codes). Cities and counties create massive bureaucracies. The nonprofits don’t just run these projects; they operate vast bureaucratic empires. These fiefdoms have overhead, marketing budgets, and executive salaries that do nothing for the homeless. They do not overpay the workers in the shelter.

Sounds good, right? That is until you see the price tag. Developers don’t just build housing projects; they construct ridiculously overpriced, overbuilt housing projects. (Keep in mind Ventura’s permitting fees and stringent building codes). Cities and counties create massive bureaucracies. The nonprofits don’t just run these projects; they operate vast bureaucratic empires. These fiefdoms have overhead, marketing budgets, and executive salaries that do nothing for the homeless. They do not overpay the workers in the shelter.

Set Up For Failure

Ventura selected Mercy House from Orange County to run its homeless shelter. Larry Haynes, Marcy House’s president, said in a speech in Ventura, “Housing is, ‘An inalienable right.’”

Mr. Haynes believes a cornerstone to Mercy House’s success in Ventura depends on developing affordable housing. Herein lies the rub. If Ventura doesn’t build affordable housing, how does that impact Mercy House’s performance? Affordable housing isn’t something Ventura has been able to do historically. “It makes it harder,” he said.

The City of Ventura has 555 homeless people. Of those, 387 are unsheltered. The Homeless Shelter will house 55 people from Ventura, leaving 332 people vulnerable.

Ventura will spend $712,000 each year for its 55 beds in the new homeless shelter. That equates to $12,945 per bed per year. And if what Mr. Haynes says is true, expect the city to pay more and more on homelessness and less on other services.

Anthony Mele, Jr. Murder

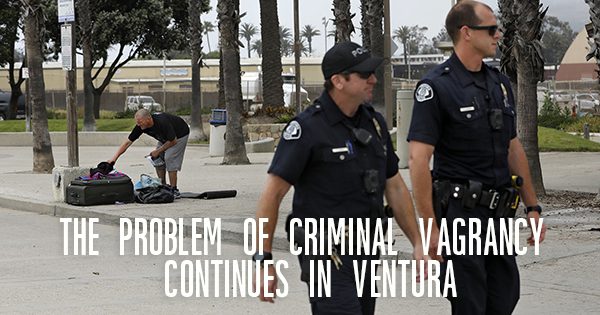

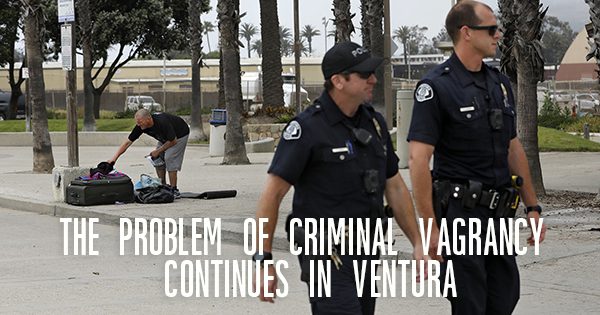

Jamal Jackson stabbed Anthony Mele, Jr. to death on Ventura’s Promenade in April 2018, thrusting the city into the national news.

Jackson was a repeat offender and was homeless. Many citizens jumbled his criminal act and his impoverished state. Of Ventura’s 555 homeless, 85 (32.7%) have mental health problems, and 93 (35.8%) have substance abuse problems.

The crime prompted an immediate reaction by Ventura Police. First, patrols along the promenade increased. At first, two officers patrolled the boardwalk 20 hours per day. Shortly after that, police expanded the patrol radius to include downtown. In July 2018, the City Council approved funds to continue the patrols. Now two officers patrol 12 hours per day. Arrest data increased since the incident. Ventura Police still deal with a significant number of recidivist criminal homeless.

Following the incident, the Police department reviewed its procedures. Chief Ken Corney admitted poor judgment. Substituting video monitoring for an officer responding was not the right choice.

Since then, there have been changes to the security camera monitoring. The changes include:

Extra cameras, active surveillance, more training, changes in monitoring policy, and re-prioritization of Calls for Service response. The review also concluded that the police adequately prioritized the call when it came in.

Public outcry diminished, but the problem of criminal vagrancy continues beyond the 2010s.

Real Estate Blunders Throughout The 2010s

The city mismanages taxpayer money on real estate deal routinely. In the past decade, there have been several notable instances: Brooks Institute, the WAV Building, the Harbor Church and the city parking garage. In each case, the mistakes have cost taxpayers’ money.

Brooks Institute

With Brooks Institute, the City Council believed relocating the school downtown would benefit the city. The City Council’s good intention went wrong. Brooks Institute was financially insolvent. It pulled out of town contractors and the city money.

The folks at City Hall tried hard to put on a brave and jubilant face in trying to explain why their decision to accept $71,000 to settle a lawsuit against Brooks Institute is a victory. Readers of this letter know better. The settlement does not even cover the rents and security deposit that Brooks was to have paid in the first six months of their lease. Nor does it account for the future lost rents and property damages. By our best estimate, the city lost well over $261,000 in this settlement.

The WAV Building

Ventura completed construction on the WAV (Working Artists of Ventura) Building at the beginning of the decade. The building included 82 low income and subsidized housing units, commercial spaces and 13 condos for sale at market rate.

What did the WAV Building cost? $55 million according to the city. That figure is too low, however. It doesn’t consider the cost of the 1.7 acres of city-owned property Ventura sold to the developer for $1. It also doesn’t include the $1.5 million in deferred permit fees. A reasonable estimate put this at $65 million.

The city acquired tax money from many sources to pay for construction, but it was not enough. Then city officials did something devious to finance completing construction. They took $1 million from the Ventura Water funds, transferred it to the Public Art Fund, then loaned the money to the project. Even worse, the city subordinated the loan to a $4.5 million mortgage from Chase. Selling the 13 condos for between $725,000 to $850,000 each would repay the city’s inter-department loan.

The concept flopped. The condos finally sold in 2018 for a fraction of what the city hoped to get. Buyers paid $413,000-$470,000 for the units. Once the sale completed, the mortgage holder, Chase, was repaid both principal and interest. Ventura Water was left holding the bag, however, for the $1 million “loaned” to the city. The city received only $105,893 from the sale of the condos after paying the Construction Loan, sales commissions, sales expenses, the City Deferred Impact Fee Loan and the developer.

The concept flopped. The condos finally sold in 2018 for a fraction of what the city hoped to get. Buyers paid $413,000-$470,000 for the units. Once the sale completed, the mortgage holder, Chase, was repaid both principal and interest. Ventura Water was left holding the bag, however, for the $1 million “loaned” to the city. The city received only $105,893 from the sale of the condos after paying the Construction Loan, sales commissions, sales expenses, the City Deferred Impact Fee Loan and the developer.

What’s more, the city loaned $2 million to the Regional Development Agency (RDA) to build the WAV project. The city expected to be repaid $1 million before the California Assembly eliminated RDAs statewide. Ventura wrote off $1 million when the RDA disappeared. Ventura is pursuing the outstanding principal and interest through the Recognized Obligation Payment Schedule (ROPS), but has received nothing so far.

All totaled, Ventura lost $1,894,107 on the sale of the condos.

Former Mayor Bill Fulton projected the project would “produce 25,000 visitors a year and would stimulate the local economy, resulting in $75,000,000 in new investments.” He also said the city used no local tax dollars to build the WAV Building.

The reality is that most of the money came from Federal and State taxes. But the funds noted above came from the city, plus another $334,176 to offset various construction fees.

As for the $75 million in new investment, we will never know because the estimator, Bill Fulton, left town.

At the time, we noted our elected representatives lack the understanding, the capacity to ask the more profound questions or political will to stop these types of actions.

Harbor Church

The city paid church officials $2.3 million to buy the Harbor Church property in 2016. City Hall and Harbor Church agreed the value of both the land and the church building was $1.6 million. The actual sales price included an extra $700,000 to pay the Church to move. By any measure, Ventura overpaid for the property.

Downtown Parking Garage

And there was a mistake with the city parking garage—the city grants private, reserved parking spaces to select businesses downtown as an incentive to operate. The city approved ten parking spaces to entice Cinemark Theaters to remain downtown. The trouble was when Lure Restaurant opened at 66 California, and the city staff provided them the same ten spots. This may not seem like a big blunder, but it shows that the city is inept at managing real estate, or the staff lacks good leadership to make sure mistakes don’t occur.

We’ve believed the city should get out of the real estate business throughout the 2010s. The litany of poor decisions grows. Ventura owns commercial real estate throughout the city. As these examples demonstrate, the city has not made responsible decisions regarding these properties. At the very least, the city should seek advice from licensed realtors and experts whenever making a real estate decision.

Grand Jury Finding

The 2011-2012 Ventura County Grand Jury opened an inquiry and issued a report condemning the City of Ventura’s Code Enforcement practices. The report addresses the aggressive collection of fees by Code Enforcement, motivated by the need to raise more revenue.

City government and Code Enforcement officers serve a valuable and essential service to our community until they start acting like bullies with their use of force, intimidation, abuse of power and excessive punishment of the citizenry.

City government and Code Enforcement officers serve a valuable and essential service to our community until they start acting like bullies with their use of force, intimidation, abuse of power and excessive punishment of the citizenry.

At the time, the city’s response to this report demonstrated their lack of understanding or constituted a brazen and irresponsible attempt to obfuscate the truth when they dismissed the report as vague. It was not.

For much of the 2010s, citizens overlooked or forgot the Grand Jury’s report until we had the Thomas Fire. Suddenly, city permitting and inspection of new buildings was of paramount importance. Sadly, stories from the fire’s victims indicate nothing has changed at City Hall.

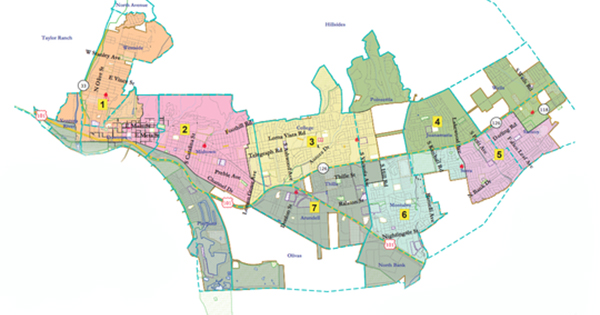

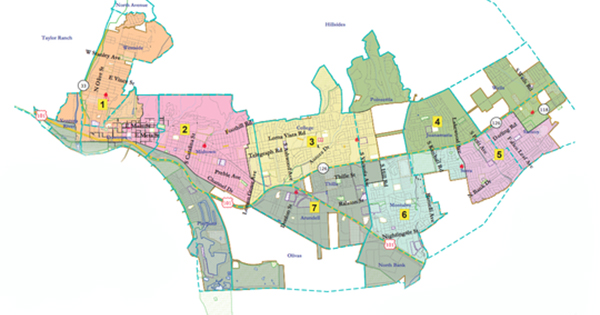

District Elections

For the first time in Ventura’s history, voting districts divide the city. The districting forced Mayor Neal Andrews and Councilmember Mike Tracy to retire. Councilmember Jim Monahan decided to retire after forty years of service. New Councilmembers are bringing fresh perspective and energy to the Council. They also are facing a steep learning curve to be effective.

Governing by districts means inexperienced new Councilmembers will lead the city. Inexperience leads to two possible outcomes. First, existing Councilmembers and city staff may marginalize them until they gain experience and knowledge. Second, the new City Manager and the city staff may take more control without voter accountability. Neither of these is good.

Citizens will now expect their elected officials to represent their district’s interests. As a result, concern for the city as a whole may take a backseat to districtwide issues. The loss of a citywide perspective on the Council is distressing.

Nowhere was this more evident than in the first forum for District 1 candidates. Citizens expressed concern for a Westside pool, learning how governing by districts will work, affordable housing and labor force opportunities. Very few of these issues aligned with what the outgoing City Councilmembers thought was most important: 1) growth 2) water 3) homelessness and 4) staff accountability.

Editor’s Comments

We will remember the 2010s as one of the most significant decades in Ventura’s history. It was a decade that saw our city leaders allow uninformed good intentions to overrule good governing. As a result, the city finds itself with budget deficits for the next five years. This is due, in part, to a growing pension debt obligation. The city is poised to pass along the most substantial rate increase for water in its history. The money the city spends on homelessness will grow. So, it shouldn’t come as a surprise that the city will have to raise taxes, cut services or a combination of the two.

The groundwork laid by city leaders in the 2010s provides a shaky foundation for the 2020s. The specter of higher taxes and reduced city services looms. Several things must happen to overcome the city’s current situation.

First, The City Council must have a cohesive, long-term vision. That vision must focus on the fundamentals of governing: public safety, maintained streets, safe neighborhoods, clean, affordable water, and business growth. In the early 2010s, the Council had a vision, but it didn’t concentrate on the fundamentals. As a result, the Council left the city with the Wishtoyo Consent Decree and the WAV Building. From 2013 on, the Council was divided and lacked any vision. The landmark accomplishment of those Councils was to push the Measure O sales tax increase. Yet, if you ask ordinary citizens how the extra money helps them, they’d be hard-pressed to answer.

Second, Ventura must retain a City Manager for more than three years. The City Manager leads the city staff to fulfill the City Council’s vision. Constant turnover disrupts that vision. A City Manager needs time to build a team and get them performing at a high level. We hope our current City Manager, Alex McIntyre, will have the opportunity to show the city what he’s capable of doing.

Third, voters must get involved. District voting means every vote is more important than it’s ever been. Your vote is one in 15,000 potential voters in your district. Your ballot carries more value than it did when we had citywide elections and your vote was one of 64,976. If the city is to overcome the current obstacles, we can’t have districts in which only 3,781 voters cast ballots.

Tell City Council, “Don’t Repeat The Mistakes Of The 2010s.”

Below you’ll find the photos of our current City Council. Click on any Councilmember’s photo and you’ll open your email program ready to write directly to that Councilmember.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

For ten years, Ventura has done little to remedy its unfunded pension liabilities. During that time, there have been four different City Councils. Yet, they made only a modest effort to solve the problem. Then-Mayor Bill Fulton and City Manager Rick Cole claimed in 2011 that the City of Ventura had tilled new ground by requiring the city employees to pay something toward their retirement – 4 ½%.

For ten years, Ventura has done little to remedy its unfunded pension liabilities. During that time, there have been four different City Councils. Yet, they made only a modest effort to solve the problem. Then-Mayor Bill Fulton and City Manager Rick Cole claimed in 2011 that the City of Ventura had tilled new ground by requiring the city employees to pay something toward their retirement – 4 ½%. Make beneficiaries pay more. With the city covering 100 percent of the unfunded liability, the problem will continue to grow. There will be minimal reforms because the actuarial losses fall on the taxpayer. Capping the employer contribution at a fixed percentage of salary would cut pension costs for the city. As pension costs increase over the years, the employees will pay all the growing costs.

Make beneficiaries pay more. With the city covering 100 percent of the unfunded liability, the problem will continue to grow. There will be minimal reforms because the actuarial losses fall on the taxpayer. Capping the employer contribution at a fixed percentage of salary would cut pension costs for the city. As pension costs increase over the years, the employees will pay all the growing costs.

Sales taxes will be severely impacted by the COVID 19 pandemic, and

Sales taxes will be severely impacted by the COVID 19 pandemic, and  The most considerable expense for any city is payroll—including benefits and retirement. The salaries, benefits and pensions are all controlled by labor contracts. In fact, because of the COVID 19 pandemic, these costs will likely blow up. The Ventura City Council’s control of this expense is limited to reducing staffing levels. Here are examples that the City Council is considering.

The most considerable expense for any city is payroll—including benefits and retirement. The salaries, benefits and pensions are all controlled by labor contracts. In fact, because of the COVID 19 pandemic, these costs will likely blow up. The Ventura City Council’s control of this expense is limited to reducing staffing levels. Here are examples that the City Council is considering.  There are other costs the Council can influence. It’s time the City Council scrutinizes all the cost of services to consider less costly options. Those services can be General Fund items like fire and police, or they can be other operational items like water.

There are other costs the Council can influence. It’s time the City Council scrutinizes all the cost of services to consider less costly options. Those services can be General Fund items like fire and police, or they can be other operational items like water.

It’s remarkable that the city accomplished anything in the 2010s. We had three City Managers and three Interim City Managers. No one person was in the role for more than three years. Turnover created a leadership vacuum that minimized any chance for meaningful change.

It’s remarkable that the city accomplished anything in the 2010s. We had three City Managers and three Interim City Managers. No one person was in the role for more than three years. Turnover created a leadership vacuum that minimized any chance for meaningful change.

The Consent Decree stems from a federal complaint filed by Whistoya Foundation [

The Consent Decree stems from a federal complaint filed by Whistoya Foundation [

Sounds good, right? That is until you see the price tag. Developers don’t just build housing projects; they construct ridiculously overpriced, overbuilt housing projects. (Keep in mind Ventura’s permitting fees and stringent building codes). Cities and counties create massive bureaucracies. The nonprofits don’t just run these projects; they operate vast bureaucratic empires. These fiefdoms have overhead, marketing budgets, and executive salaries that do nothing for the homeless. They do not overpay the workers in the shelter.

Sounds good, right? That is until you see the price tag. Developers don’t just build housing projects; they construct ridiculously overpriced, overbuilt housing projects. (Keep in mind Ventura’s permitting fees and stringent building codes). Cities and counties create massive bureaucracies. The nonprofits don’t just run these projects; they operate vast bureaucratic empires. These fiefdoms have overhead, marketing budgets, and executive salaries that do nothing for the homeless. They do not overpay the workers in the shelter.

The concept flopped. The condos finally sold in 2018 for a fraction of what the city hoped to get. Buyers paid $413,000-$470,000 for the units. Once the sale completed, the mortgage holder, Chase, was repaid both principal and interest. Ventura Water was left holding the bag, however, for the $1 million “loaned” to the city. The city received only $105,893 from the sale of the condos after paying the Construction Loan, sales commissions, sales expenses, the City Deferred Impact Fee Loan and the developer.

The concept flopped. The condos finally sold in 2018 for a fraction of what the city hoped to get. Buyers paid $413,000-$470,000 for the units. Once the sale completed, the mortgage holder, Chase, was repaid both principal and interest. Ventura Water was left holding the bag, however, for the $1 million “loaned” to the city. The city received only $105,893 from the sale of the condos after paying the Construction Loan, sales commissions, sales expenses, the City Deferred Impact Fee Loan and the developer. City government and Code Enforcement officers serve a valuable and essential service to our community until they start acting like bullies with their use of force, intimidation, abuse of power and excessive punishment of the citizenry.

City government and Code Enforcement officers serve a valuable and essential service to our community until they start acting like bullies with their use of force, intimidation, abuse of power and excessive punishment of the citizenry.

current ones—have been met with furious opposition. Workers’ representatives and also the plan managers themselves—like CalPERS—oppose changes. That opposition has been mostly successful. Governments at all levels are hamstrung between their duties to provide on-going services to their citizens and their ever-increasing financial obligations to pension funds. In the State of California, once one hires an employee, their retirement cannot be changed.

current ones—have been met with furious opposition. Workers’ representatives and also the plan managers themselves—like CalPERS—oppose changes. That opposition has been mostly successful. Governments at all levels are hamstrung between their duties to provide on-going services to their citizens and their ever-increasing financial obligations to pension funds. In the State of California, once one hires an employee, their retirement cannot be changed.

There are two other choices for our City Council to consider if they have the political will to do anything about this crisis that will cripple the City of Ventura.

There are two other choices for our City Council to consider if they have the political will to do anything about this crisis that will cripple the City of Ventura. Public sector employees may resist the changes but think about it. Private sector employees don’t get their full social security until 65 or even 67, depending the year they were born. Moreover, Social Security is only going to be one quarter to one-half of your working earnings.

Public sector employees may resist the changes but think about it. Private sector employees don’t get their full social security until 65 or even 67, depending the year they were born. Moreover, Social Security is only going to be one quarter to one-half of your working earnings.

“If you don’t know where you are going, any road will get you there.”

“If you don’t know where you are going, any road will get you there.”

The new City Council can take three steps to address water. First, they must request a modification to

The new City Council can take three steps to address water. First, they must request a modification to Housing Ventura’s homeless was a high priority. Some thought affordable housing was the solution. Others mentioned the homeless shelter. Some interviewees distinguished between the mentally ill living on the streets and the vagrants. Each saw it as a countywide problem with Ventura as its nexus. The county jail and the psychiatric hospital are in Ventura, making the city a natural final destination for the homeless to stay. One interviewee described it as a “catch and release” program by the other cities into Ventura.

Housing Ventura’s homeless was a high priority. Some thought affordable housing was the solution. Others mentioned the homeless shelter. Some interviewees distinguished between the mentally ill living on the streets and the vagrants. Each saw it as a countywide problem with Ventura as its nexus. The county jail and the psychiatric hospital are in Ventura, making the city a natural final destination for the homeless to stay. One interviewee described it as a “catch and release” program by the other cities into Ventura. The new Council needs to apply critical thinking and be willing to question all city staff reports and recommendations. To do so requires financial literacy. Each Councilmember must study the city budget and Comprehensive Annual Financial Report (CAFR).

The new Council needs to apply critical thinking and be willing to question all city staff reports and recommendations. To do so requires financial literacy. Each Councilmember must study the city budget and Comprehensive Annual Financial Report (CAFR). Many complex issues face Ventura. All City Council candidates need to be aware of the problems and have a plan to address them. We can’t rely on the candidates alone to be knowledgeable. It’s each person’s responsibility to be aware of the challenges before us. It’s equally important that each voter be confident that the candidates understand them. Only then do our elected officials represent us

Many complex issues face Ventura. All City Council candidates need to be aware of the problems and have a plan to address them. We can’t rely on the candidates alone to be knowledgeable. It’s each person’s responsibility to be aware of the challenges before us. It’s equally important that each voter be confident that the candidates understand them. Only then do our elected officials represent us

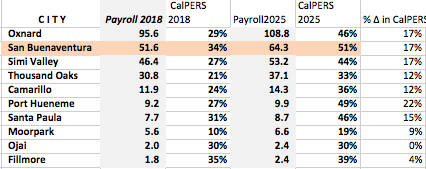

Ventura is already paying 34 cents to CalPERS for every dollar it pays its active employees. In six years, that amount will go up to an unsustainable 51 cents for every dollar of payroll—more than any city in Ventura County. Pensions are already crowding out other essential city services like filling potholes, fixing infrastructure and even hiring more police officers and firefighters.

Ventura is already paying 34 cents to CalPERS for every dollar it pays its active employees. In six years, that amount will go up to an unsustainable 51 cents for every dollar of payroll—more than any city in Ventura County. Pensions are already crowding out other essential city services like filling potholes, fixing infrastructure and even hiring more police officers and firefighters.