Brooks Institute Fiasco Exemplifies Ventura’s Bad Money Management

“EVERYONE’S ENTITLED TO THEIR OWN OPINION, BUT NOT THEIR OWN FACTS” —Daniel Patrick Moynihan

Brooks Institute continues to be an issue

Ventura’s City Council’s bad deal with Brooks Institute exposes its lack of financial understanding. The Council

Brooks Institute closure exemplifies Ventura’s bad financial management.

and the city staff are scrambling to cover up those flaws. They’re feeding voters information designed to distract the public from the real issues. Ventura city staff believes it did enough due diligence. They’re trying to sell that opinion as fact in a Ventura Breeze article dated Sept. 13, 2016. The city staff’s facts ignore economic reality, though. Follow the money and you will always find the truth. Brooks Institute is no exception.

Everyone’s entitled to their own opinion, but not their own facts

Venturans for Responsible and Efficient Government (VREG) followed the money trail. VREG filed a Freedom of Information Act request with the city. The city provided the documents they evaluated to extend Brooks Institute a 46-month lease. What VREG learned reveals incompetence and lack of understanding.

W Brooks Institute is not an isolated problem; it’s a symptom of a larger problem. It shows the city council’s inability to manage taxpayer money. Brooks Institute surfaced at a time when the city is asking for another $270 million in taxes from Measure O.

Discovering The Cracks in the Foundation of the City’s Due Diligence

Brooks Institute exposed the cracks in the city’s procedures.

The city provided four foundational documents used to check Brooks Institute Holdings, LLC. The city staff believes these documents showed Brooks Institute was a good “risk.” In the private sector, these documents would have been insufficient. Here is why.

1) GP Homestay’s Commitment Letter Is Meaningless from a Financial Perspective

GP Homestay, Brooks Institute’s parent company, provided Ventura a ‘letter of guarantee.’ City Manager Mark Watkins announced this at the September 12, 2016 City Council meeting. The decision makers considered this meaningful in the decision to lease to Brooks. The letter has many shortcomings, though.

First, GP Homestay wrote the letter to a third party,not to the City of Ventura or any entity related to the Brooks Institute lease. GP Homestay wrote it to the WASC Senior College and University Commission on January 15, 2016. WASC Senior College and University Commission is an accreditation organization for Brooks Institute’s curriculum.

Second, nobody signed the letter. It is of no value to the City of Ventura as a basis for financial support, or to any of the other groups or businesses defrauded by Brooks.

Brooks Institute parent company, GPHomestay, took advantage of Ventura and its contractors.

Third, the contents of the letter are not something the city can depend on. The letter states, “Green Planet guarantees continued financial support for the proposed period of financial losses prior to reaching the break-even balance between revenues and expenses in 2020.”

This suggests two important facts. One, GP Homestay didn’t expect Brooks Institute Holdings, LLC to be profitable during the entire term of the lease. Two, after 2020, Green Planet could withdraw any financial support. These are hardly the assurances on which to base a 46-month lease, nor do they guarantee any payment.

2) Brooks Institute’s Loan Agreement with GP Homestay Arrives after the Fact

The city provided a loan agreement for $2.5 million dated March 28, 2016 between GP Homestay and Brooks Institute Holdings, LLC. This document is worthless from a financial perspective for several reasons.

First, the loan agreement is actually for a line of credit. There is nothing that indicates that the line of credit was ever signed or if Brooks Institute drew from it.

Second, nobody from GP Homestay signed the line of credit document. An unsigned document is worthless. It is unenforceable and not the basis for granting a 46-month lease.

Third, and most important, the date on the document is 33 days after the start of the signed lease. It could not have been available for the City Council to review while doing their due diligence.

The city approved the lease on February 22, 2016—more than a month before this document. So this document could not have factored into the decision to lease to Brooks Institute.

3) Dissecting Green Planet, Inc.’s Consolidated Opening Statement Balance Sheet

Green Planet, Inc. provided a consolidated statement to the city to support a 46-month lease. The statement dates back to June 16, 2015, making it eight months old at the time the city issued the lease.

Green Planet, Inc. consolidated statement includes six other corporations. To understand Brooks Institute Holdings, LLC, the city would have to separate out each of these corporations. That’s impossible with this statement. So, depending on this document for financial information would have been a waste of time. To cap it off, Green Planet, Inc. did not provide any guarantees to the city of the Lease Agreement or the construction period. This document doesn’t support the decision to lease space to Brooks Institute Holdings, LLC.

4) Brooks Institute Holdings, LLC Financial Documents Don’t Paint a Pretty Picture

The financial statements Brooks Institute Holdings, LLC provided lacked substance. First, the statements covered four months. Brooks Institute Holdings, LLC only existed since March 2, 2015.

Upon examining the financial statements, several irregularities signaled danger and demanded further questions. For instance, Brooks Institute Holdings, LLC’s available cash. Brooks would have had only $403,805 in cash if it paid all current liabilities. The balance sheet showed a cash balance of $2,750,598 and Current Liabilities of $2,346,793.

This statement was seven months old when the City Council discussed the lease agreement. Yet the city didn’t verify Brooks Institute’s available cash by demanding bank statements. The city had no way to know how much cash Brooks had available.

The Statement of Income showed a Net Operating Loss of $21,531. GP Homestay expected this loss and future losses until the year 2020, as they stated in their letter. Yet, the Statement of Income is misleading. The Statement of Income shows Net Income of $1,738,026. This is the result of the acquisition of the school valued at $1,759,557. The only reason it showed a Net Income was due to the value it placed on acquiring itself. An acquisition is a one-time, extraordinary event. It does not show true profitability.

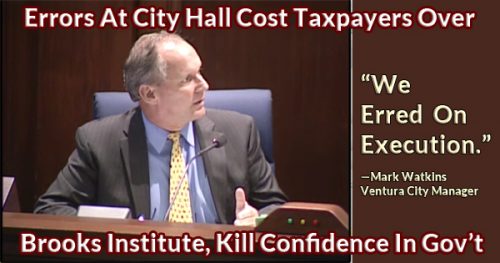

The Scramble to Cover Up the Flaws

The city began spinning the story soon after Brooks Institute closed its doors. First, there was City Manager Mark Watkins’ public mea culpa in the Ventura County Star. In it, he stated the city erred on execution on Brooks Institute by not collecting rents and fees. Next, there was an article in the Ventura Breeze by “City Staff” (whoever that is). It read, “As part of the City’s due diligence in determining the viability of the lease, the City was provided access to Brooks’ and its parent company’s (GPHomestay) confidential financial information. Based on that review it was determined that Brooks was solvent.” City Staff hoped nobody would discover the truth by examining the financial statements. Finally, there is Councilmember Cheryl Heitmann’s plea. She urged the city to get out in front of the problem at the September 12, 2016 council. She reckoned citizens were forming their own opinions without the city’s input.

The city’s rush to move Brooks Institute downtown forced city staff to cut corners.

The truth will out. The city was eager to do the lease with Brooks Institute. The city did a minimal review to rush the deal. After the fact, the City Manager admitted errors in the process. He stopped short of saying the city approved the lease without proper supporting documents. And the city failed to ask and answer many questions before it signed the lease. Even a cursory examination revealed Brooks had only $403,805 in cash. Brooks lacked enough funds to remodel the City site, let alone several other locations.

This situation will take years to resolve. Here’s what we do know now. Brooks Institute closed. The city has unpaid rents. Brooks stiffed contractors for tenant improvements they completed. The city will have to renovate the buildings Brooks leased to lease them to someone else. Brooks Institute Holdings, LLC didn’t couldn’t fulfill its obligations on the 46-month lease agreement. And, neither the city staff or the City Council researched enough before issuing a long-term lease agreement.

These are the facts. The city is trying to distract the public by zeroing in on the amount of money the city lost. The City Council and the City Manager want voters to believe the losses were $70,000. That amount of money is significant in itself. It may not be the full extent of the city’s exposure to losses, though. The real exposure is closer to $1,095,000. There is the $70,000 in lost rents from Brooks Institute. There is also the $825,000 mechanic’s lien by the contractors that the city refuses to pay. There will likely be legal costs to defend that position. Finally, it will cost $200,000 to return the sites into leasable condition according to Mark Watkins.

Editor’s Comments

The city played fast and loose with taxpayer money on the Brooks Institute deal. The city made several public apologies. They sympathized with the Brooks Institute students and facility over their loss. Yet, they admitted no wrongdoing. There was no apology to the City Council for making them look foolish and uninformed. But, worst of all, the city didn’t apologize to the taxpayers. It’s the taxpayers who pay for the city’s mistakes.

With or without an apology, though, one thing remains clear. The city has mismanaged taxpayer money on Brooks Institute. The situation demonstrates city staff and City Council’s incompetence or lack of understanding. So, it would be imprudent or foolhardy to trust this City Council with another $270 million through Measure O. Don’t give city government more money until they show they can spend the money they have. Vote No on O.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Leave a Reply

Want to join the discussion?Feel free to contribute!