How The Right Steps In The 2019 Budget Make Your Tomorrow Better

“Giving money and power to government is like giving whiskey and car keys to teenage boys.”

—P.J. O’Rourke

Ventura faces severe revenue shortfalls in six of the next seven years, the size of those during The Great Recession. Ventura is on pace to lose over $9.07 million over the next six years. You should be concerned about the financial conditions in the City of Ventura, and you should also know this budgetary crisis is avoidable if the City Council acts this year.

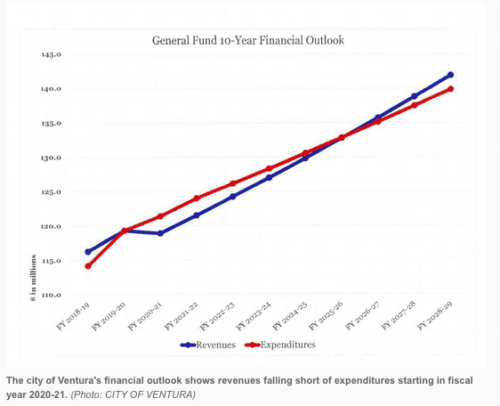

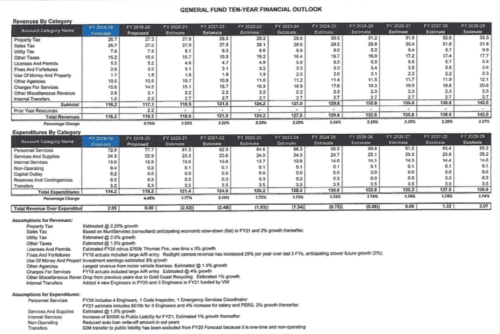

Ventura’s General Fund Financial Outlook For The Next 10 Years

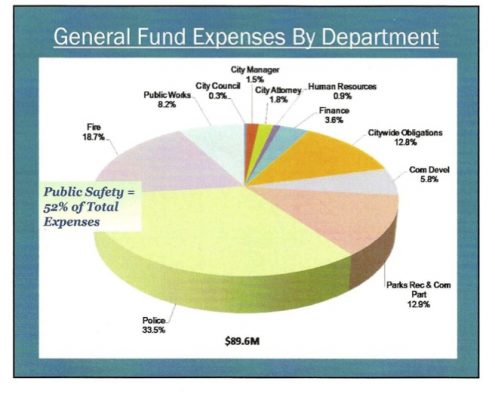

Ventura city staff calculate the city’s revenue and expenses for the next ten years [see graphic]. Costs will exceed income for six consecutive years beginning in the fiscal year 2020-2021—that’s next year.

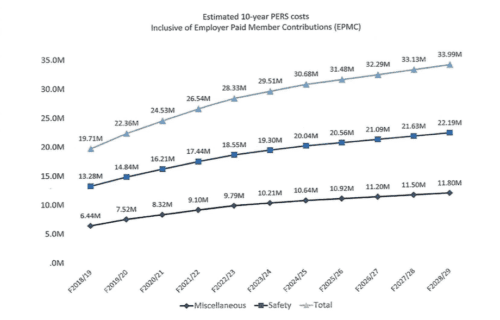

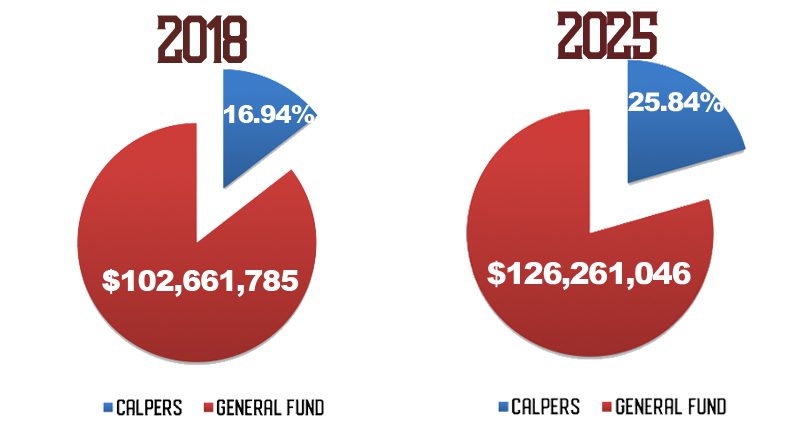

Pensions are the main reason for the rise in expenditures. Annual pension costs will climb to $31.48 million from $19.71 million by the fiscal year 2025-2026. That’s an $11.63 million increase. The city projects property and sales taxes to increase by only $10.6 million over the same period. Not a rosy outlook.

Next year (the fiscal year 2020-2021), Ventura faces a $2.52 million deficit because of the $2.17 million in rising pension costs.

The city staff estimations are optimistic. They do not factor in a recession, which some believe is imminent. If a recession comes, people will lose jobs. Also, if a recession hits, property and sales tax revenues will suffer and projected losses may be even worse. What’s more, the city plans to add no money to reserves in the fiscal year 2019-2020. Current reserve levels for the City of Ventura will keep the city government running for only 45 days.

Wasn’t Measure O supposed To Save The Budget?

Measure O passed three years ago and will continue for the next 22 years. It brings in $10.8 million in additional sales tax revenue each year. Still, it isn’t enough to cover the projected shortfalls. Why is that?

There are several reasons why Measure O can’t save the city’s budget. First, there is no consensus among the City Councilmembers about how to use Measure O money. Alex McIntyre, Ventura’s new City Manager, asked all seven Councilmembers individually how they would spend it. All seven Councilmembers gave differing opinions on how to use the Measure O taxes. Without clear direction, it’s difficult for the City Manager to focus the city staff on what’s most important for our city. Confusion over Measure O is one example of how the City Council is dysfunctional on the budget’s priorities.

A second problem is how special interest groups lined up to get their share of Measure O. At the May 20th City Council meeting, Councilmembers Lorrie Brown, Jim Friedman and Mayor Matt LaVere tried to move funds from Measure O to the General Fund for Fire Station No. 4. The Star report said the Fire Department union members felt insecure (sic) about Station No. 4 funding coming out of a temporary tax fund. (The tax lasts for 25 years)

A second problem is how special interest groups lined up to get their share of Measure O. At the May 20th City Council meeting, Councilmembers Lorrie Brown, Jim Friedman and Mayor Matt LaVere tried to move funds from Measure O to the General Fund for Fire Station No. 4. The Star report said the Fire Department union members felt insecure (sic) about Station No. 4 funding coming out of a temporary tax fund. (The tax lasts for 25 years)

In 2016, The City Council sold Measure O to voters with the promise that Fire Station No. 4 would remain open with its funds. Voters agreed to the idea of a temporary 25-year tax. VFD is now trying to persuade the City Council that when Measure O expires, there may not be funding for Fire Station No. 4. They fearmonger that response times to calls will increase, and lives could be lost. A 4-3 vote defeated the motion.

While this City Council takes precious time debating moving funds from one column to another, the growing unfunded pension obligations put pressure on the entire city budget, even with Measure O.

The Canaries In The Coal Mine

Economic disasters are all around us. There is no reason to think that Ventura is immune to them. The City of Oxnard is preparing to lay off hundreds of employees. They also plan to close a fire station and reduce the number of fire personnel available to respond to emergencies. The Oxnard City Manager says, “We are down to bare bones.” What’s happening in Oxnard is a preview of what could happen in Ventura unless the City Council acts quickly.

Economic disasters are all around us. There is no reason to think that Ventura is immune to them. The City of Oxnard is preparing to lay off hundreds of employees. They also plan to close a fire station and reduce the number of fire personnel available to respond to emergencies. The Oxnard City Manager says, “We are down to bare bones.” What’s happening in Oxnard is a preview of what could happen in Ventura unless the City Council acts quickly.

Ventura County Medical Center is losing over $40 million per year. That adds more unemployment to our community. With the City of Ventura own forecast of financial shortfalls, the City Council would do well not to ignore the economic disaster warning like ‘a canary in a coal mine.’

How Do We Fix The Budget?

The budgetary crisis is entirely avoidable if the City Council acts now. The solutions are simple, but they are not easy. It requires significant political will and resolve.

The budgetary crisis is entirely avoidable if the City Council acts now. The solutions are simple, but they are not easy. It requires significant political will and resolve.

Improve The Budgeting Process

Currently, the City Council approves the city’s annual budget one year at a time. It doesn’t consider subsequent years’ financial demands. Given that the 10- year forecast shows losses for the next six years’ budgets, to ignore the next six years will be pushing the problem “down the road.”

Now is the time to change this systemic shortsightedness. City Councilmembers have the opportunity to discuss budgeting on at least a 3-year basis, not one year at a time.

Not Filling All Open Positions In City Hall

To balance the budget over the next six years, the city staff has two potential solutions. They can increase revenue through taxes and fees or reduce expenses. Since it’s not easy or popular to raise taxes and fees, the alternative is to cut costs.

The single largest expense category is city employees. Cutting staff is the obvious choice to reduce expenses. To avoid the unpopular cutting of current employees, the City Council can take a less unpleasant path and cut positions in the budget that the city never filled.

There are currently sixty unfilled positions at City Hall. If each vacant position costs the city $100,000 per person (salary, overtime, retirement and benefits), the cost to budget for these open positions adds to the projected deficit (losses).

If the city reduces the unfilled positions to thirty instead of sixty, the savings to Ventura would be $3 million per year. A $3 million reduction in expenses will balance the budgets for the next six years.

This decision puts the City Council on the horns of a dilemma. Should they hire all sixty positions now and later fire employees during the budget shortfalls? Alternatively, should they hire only thirty people knowing they can add personnel if the city’s economic situation improves? Eliminating unfilled staff positions is less disruptive to city government than laying people off.

Economic Development

An alternative toward improving the budget is to attract new or expanding businesses to Ventura. Several Councilmembers understand this and agree. More business and local jobs are the best solution for filling the budgetary shortfalls. More jobs generate more sales tax, encourage community spending and increase property values. Higher property values increase property taxes and reduce blight.

Imagine the stimulus to the community of filling the old Star Free-Press building or the Toys-R-Us location would have.

Imagine the stimulus to the community of filling the old Star Free-Press building or the Toys-R-Us location would have.

The city has already taken the first step in this direction. City Manager, Alex McIntyre, has moved the Economic Development division under the City Manager from under Community Development. Elevating the reporting of this department to the City Manager signals the increased importance economic development has for the city.

Empower The Economic Development Manager

Another simple step the city could take would be to empower the Economic Development Manager (EDM). The EDM must have readily available an inventory of all commercial locations, complete with square footage, zoning, parking, pricing, and a list of commercial real estate agents and contact information.

The City Council must be ready to provide incentives to new or expanding businesses. The incentives must include fee reductions and process simplification to entice the companies. One such motivator must be a single contact within the city who will guide the relocation process through the bureaucracy.

Finally, the EDM must identify and target new commercial business to locate in Ventura.

Each of these positive steps toward economic development has one drawback. They are long-term solutions. None of them will happen quickly enough to fix a budget by next year.

Streamline the City Hall Experience

The city has started reorganizing boards and commissions that oversee Planning, Design Review, Historic Preservation, and other committees filled by residents appointed by the City Council. While this is a good start, it must go further.

Reducing boards and commissions saves staff time in preparing and attending meetings. The staff attends about 20 meetings a month. Fewer meetings will allow more time for the employees to better supervise operations in planning, design review, code enforcement, etc.

The city must look at other ways to reduce staff time in other duties—especially if the city hires only thirty of the sixty unfilled positions. All staff operations should be scrutinized to end obsolete or redundant activities.

Revamp Ventura Fire Department

Now is a good time to modernize the fire department. Ventura Fire operates in much the same way it did 100 years ago except the needs are far different:

- Building codes are stricter making fires less frequent

- More buildings have sprinkler systems

- Over 75% of calls are for paramedics

Each fire station has paramedics on duty to serve those calls. In addition to Ventura Fire, each medical emergency requires an ambulance from a private company in case a victim needs transporting to the hospital. Rolling a fire truck plus an ambulance seems like duplicated efforts.

Any change to the Fire Department would likely be unpopular with the public. That makes it a subject considered by Councilmembers, to be too controversial to discuss. The fire department union will become protective of their fellow firefighters and will want to preserve the status quo.

Any change to the Fire Department would likely be unpopular with the public. That makes it a subject considered by Councilmembers, to be too controversial to discuss. The fire department union will become protective of their fellow firefighters and will want to preserve the status quo.

As they have in the past, the unions will apply pressure to the Council. Since four of the seven elected Councilmembers received campaign contributions from Ventura Fire in their last election, the politicians will likely concede as they have in the past. Ventura Fire Department needs reorganizing. Now is the ideal time to do it.

Editor’s Comments

The community will not support another tax rate increase. Pension costs already absorbed the entire $10.8 million raised by Measure. Still, citizens ask why the city doesn’t repair their streets and sidewalks. We can’t hope for an economic miracle to increase revenue, so the city must take steps to curb expenses. Ventura must:

- Lower expenses by not filling all open positions at City Hall. Add those costs back into the budget

- Design and target new commercial businesses to locate in Ventura

- Offer incentives and fee reductions to bring more jobs to Ventura

- Streamline the City Hall process and operations to reduce staff time. It will accelerate the processing time for building and licenses

- Streamline medical response procedures within Ventura Fire. Find ways to reduce fire department costs for those calls. Dispatching a private ambulance and fire trucks with paramedics every time is expensive

- Hold in-depth discussions at the City Council to expand budgeting to a 3-year basis, not one year at a time

INSIST THE CITY COUNCIL MODERNIZES THE BUDGET PROCESS

Below you’ll find the photos of our current City Council. Click on any Councilmember’s photo and you’ll open your email program ready to write directly to that Councilmember.

|

|

|

|

|

|

|

|

|

|

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

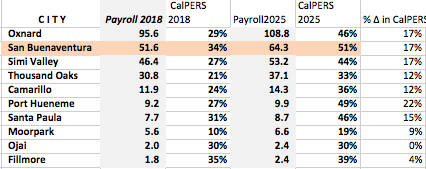

Ventura is already paying 34 cents to CalPERS for every dollar it pays its active employees. In six years, that amount will go up to an unsustainable 51 cents for every dollar of payroll—more than any city in Ventura County. Pensions are already crowding out other essential city services like filling potholes, fixing infrastructure and even hiring more police officers and firefighters.

Ventura is already paying 34 cents to CalPERS for every dollar it pays its active employees. In six years, that amount will go up to an unsustainable 51 cents for every dollar of payroll—more than any city in Ventura County. Pensions are already crowding out other essential city services like filling potholes, fixing infrastructure and even hiring more police officers and firefighters.

This November, Ventura has an unprecedented opportunity to tell the City Council, “No more new spending.” There are three open seats on the Council in this November’s election.

This November, Ventura has an unprecedented opportunity to tell the City Council, “No more new spending.” There are three open seats on the Council in this November’s election.