The Best Thing The Council Can Do About The Deficit

“History doesn’t repeat itself, but it often rhymes.”

—Mark Twain

Ventura finds itself staring down another multi-million-dollar budget deficit. This time we must overcome a 10% deficit, or $12 million.

Most people’s attention won’t be on the budget because they’re focused on COVID-19 and the upheavals it has caused. The City Council will use the pandemic as a reason to make decisions they otherwise might not make. Make no mistake, however. The budget deficit existed before COVID-19 but became worse because of the economic shutdown.

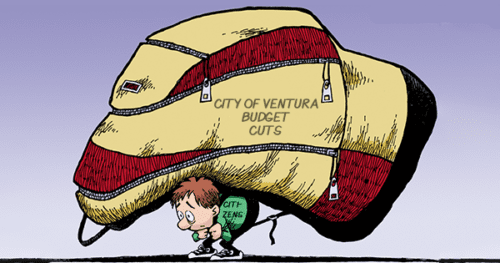

Decisions by several past City Councils have brought us to today’s $12 million budget deficit. Previous Councils have not fully replenished the city’s financial reserves and have not planned for an economic downturn like the one Ventura is facing today. Now, the current City Council must find ways to make up for the lack of vision of previous Councils.

The Covid-19 Impact

The Covid-19 shutdown put hundreds of people out of work and decimated the local economy. Six of the seven Councilmembers and many of the city staff have never experienced such a dire situation. Fortunately, City Manager Alex McIntyre has. Even so, the current conditions will test his mettle.

The spotlight will be on Mr. McIntyre as Ventura moves forward after the pandemic. The burden is squarely on him to prove his effectiveness and value. The recommendations he makes—and the decisions the City Council make—will impact the city for years to come.

What Faces Ventura

Mr. McIntyre’s challenges are daunting. The local economy is in shambles. The city government and businesses will struggle to put people back to work safely and quickly. To survive the impending recession will require working closely with the city’s three unions, Fire, Police and Service Employees International Union (SEIU). And, he will have to guide an inexperienced City Council through budgeting during a recession.

Mr. McIntyre’s challenges are daunting. The local economy is in shambles. The city government and businesses will struggle to put people back to work safely and quickly. To survive the impending recession will require working closely with the city’s three unions, Fire, Police and Service Employees International Union (SEIU). And, he will have to guide an inexperienced City Council through budgeting during a recession.

Sales taxes have been severely impacted by the COVID 19 pandemic. Sales tax revenue has plummeted. The auto dealers, the casino, the Pacific View Mall and restaurants aren’t generating the taxes the city expected. They are the city’s most significant contributors to sales taxes. To make matters worse, the transit occupancy tax (TOT, or bed tax) has been non-existent.

Procedures are in place to reopen businesses, but reopening will be slow. Under the best circumstances, returning to pre-pandemic sales revenue levels will take time.

Consumers are reeling from the loss of jobs, reduced hours, and volatility in the stock market. Venturans may be reluctant to return to “normal” right away based on the experience of other people in countries that have already opened up.

A Daunting Deficit

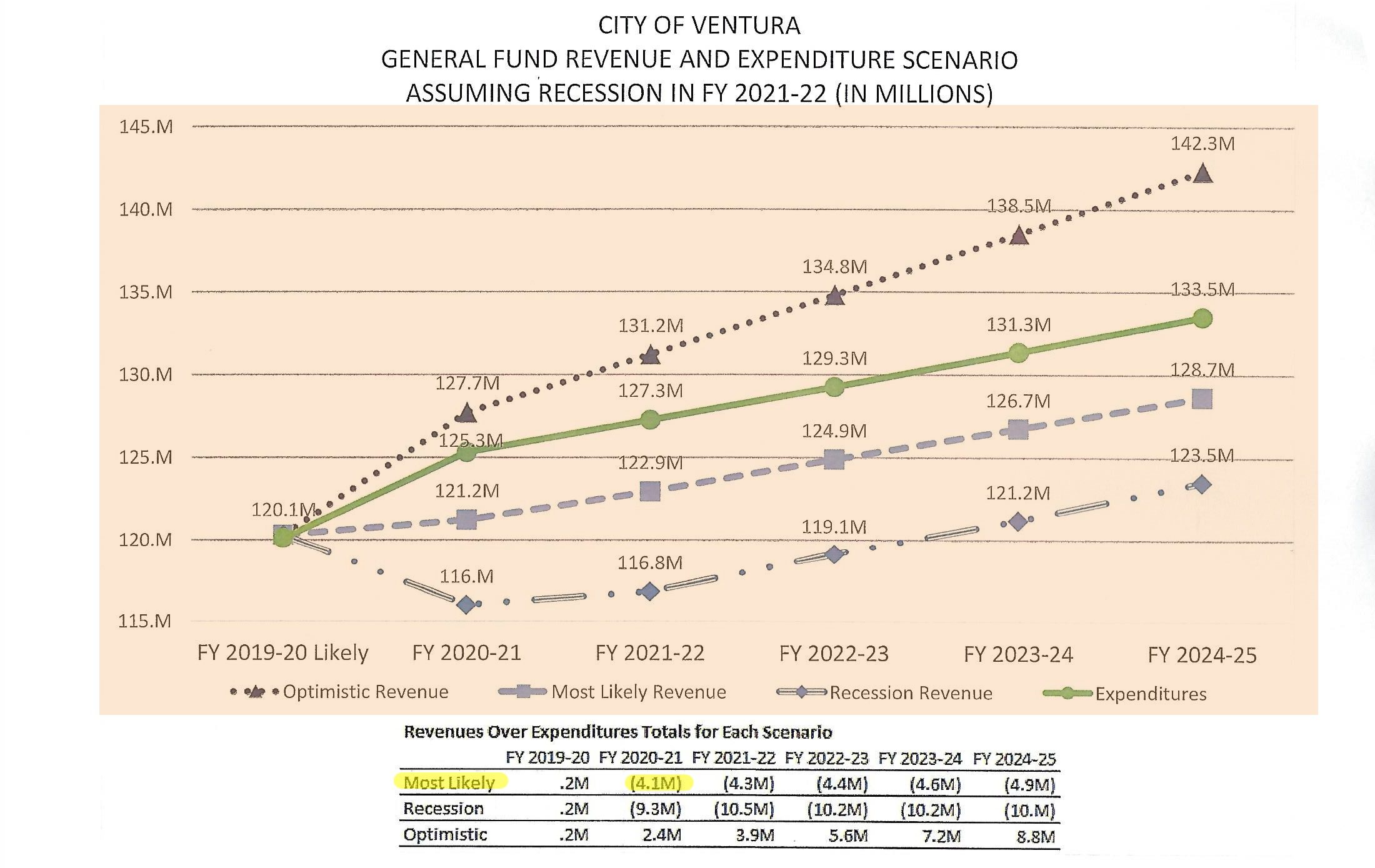

Ventura faces a budget deficit the likes of which haven’t been seen since the 2008-2009 Great Recession. Four months ago, city staff projected the 2020-2021 budget was to be a $4.1 million deficit. In April, before the effects of the business shutdown were fully realized, the gap rose to $7.2 million. Now, the staff has revised the shortfall to be about $12 million below the projected $118.7 in revenue.

Plans To Address the Deficit

The city staff presented the City Council with 13 possible ‘tools’ to balance the budget. Seven of the 13 recommendations are  personnel-related. These include:

personnel-related. These include:

- Transfer the Harbor Garage Debt to Parking Fund

- Hiring Freezes

- Reduce Employee Travel

- Eliminate of Cost-of-Living Adjustments (COLA)

- Eliminate Merit & Step Increases

- Reduce Support to Outside Agencies

- Draw from Unrestricted Fund Balance/Financial Reserves

- Increase Cost Sharing for Employee Benefits

- Reduce Benefits

- Furloughs/Reductions in Hours

- Separation Incentives (e.g., Early Retirements)

- Reduce or Eliminate Services

- Revenue Enhancements

Interestingly enough, what is missing is the ‘modification of current and future construction projects.’

Working with the Unions To Bridge The Deficit

Balancing the budget will involve cooperating with the city’s unions. There have been closed session discussions between the City Manager, Mr. McIntyre, and the union representatives.

In April, Councilmember Lori Brown reported at the Finance, Audit & Budget Committee meeting that the SEIU union rep was already circulating through City Hall. These are signs of a union anxious to defend their current status. The substance of these talks has remained private.

Hurrying City Councilmembers Up the Learning Curve

As we already described, the recovery may be slower than many would like. When confronted with a list of alternative solutions, inexperienced Councilmember might leap at the easiest, viable solution. One Councilmember seems to lean towards using all of the city’s financial reserves. While no one considers using up the city’s financial reserves to be the first option, they must answer specific questions if they choose this solution. First, how would the city replenish the reserves?

Second, what happens if the city uses all its reserves this fiscal year, but the recovery takes several years? From where will the city get the funds to pay for services in 2021-2022?

Third, how would using the city’s reserves impact the City’s bond ratings?

Another Councilmember wants to replace the word ‘Eliminate’ with ‘Defer’ COLA or Merit increases. And finally, other Councilmembers search for a solution that equally spreads the pain, sort of a “one size fits all” approach.

Another Councilmember wants to replace the word ‘Eliminate’ with ‘Defer’ COLA or Merit increases. And finally, other Councilmembers search for a solution that equally spreads the pain, sort of a “one size fits all” approach.

The problem with this narrow thinking is that it does not address unintended consequences. As an example, a 10% cut for an employee making $100,000 is far different from a 10% cut for someone making $40,000. While a $10% reduction of $40,000 is less money in absolute terms, the $4,000 reduction has a much more significant negative impact. Whereas, a 10% cut for the person making $100,000 still leaves that person with $90,000 in spendable income for food and transportation.

If the Council chooses to cut salaries, maybe a higher percentage for higher gross-salaried employees and a lower percentage for income under $100,000 would address this disparity. Over 250 Ventura city employees are making over $100,000 a year.

Voters Elected the Councilmembers to Set Policy

Voters elected the Councilmembers to set policy, set goals and let the city staff execute the plan. It should not get bogged down in the details of the City budget. As an example, the City Council recently took valuable time at a Council meeting  reviewing fee increases to discuss whether a fee should increase by 3% or $5. Such debate appears to be a poor use of City Council time.

reviewing fee increases to discuss whether a fee should increase by 3% or $5. Such debate appears to be a poor use of City Council time.

More impactful and vital discussions on how to help Ventura citizens recover faster and have more spendable income for their families is needed. For instance, this Council can spare Venturans from the potential tripling of water rates by redirecting Ventura Water’s plans. Changes can save hundreds of millions of dollars immediately.

Get Everyone Safely Working Again Safely

The state and the County Board of Supervisors have outlined the Phase Two procedures to return to work. This return will be slow as businesses and governments grapple with social distancing. No one knows how long this recovery will take. However, time will eventually fix our problems. Getting all companies safely up and running will fix a lot of these budgetary problems.

One thing the pandemic has shown us is how to work efficiently. It has forced us to evaluate what’s essential and what’s not. Post-pandemic, we will need to learn to do “less with less with less.” We hope the city government heeds this lesson.

Editors Comments

A Safer Approach would be for the City Council and our City Manager to consider a combination of all 13 possible ‘budget-balancing tools.’ What’s more, they should consider deferring a few more pending projects. Take nothing on that list off the table.

A Safer Approach would be for the City Council and our City Manager to consider a combination of all 13 possible ‘budget-balancing tools.’ What’s more, they should consider deferring a few more pending projects. Take nothing on that list off the table.

In the past fifty years, there have been recessions in 1974, 1978, 1982, 1987, 1992, 1999, and 2008-2009. Each downturn caught the City Council facing a budget deficit they didn’t anticipate. It’s happened again in 2020.

We strongly suggest the City Council give City Manager Alex McIntyre the chance to do his job. Let him draw on his experience and knowledge to navigate the city through the challenges it faces. Mr. McIntyre knows what works and what doesn’t. We pay him to make these decisions. He is the one to implement the plans.

Our elected officials should not make each minor budgetary decision. Only one Councilmember has been through similar difficult times before. Some have limited experience when it comes to running a business or managing a multi-million-dollar budget.

Tell City Council To Let The City Manager Do His Job

Below you’ll find the photos of our current City Council. Click on any Councilmember’s photo and you’ll open your email program ready to write directly to that Councilmember.

|

|

|

|

|

|

|

|

|

|

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Sales taxes will be severely impacted by the COVID 19 pandemic, and

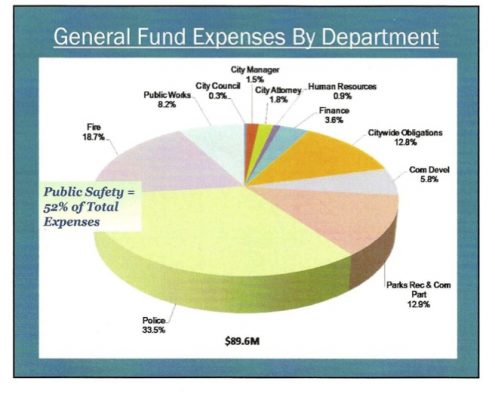

Sales taxes will be severely impacted by the COVID 19 pandemic, and  The most considerable expense for any city is payroll—including benefits and retirement. The salaries, benefits and pensions are all controlled by labor contracts. In fact, because of the COVID 19 pandemic, these costs will likely blow up. The Ventura City Council’s control of this expense is limited to reducing staffing levels. Here are examples that the City Council is considering.

The most considerable expense for any city is payroll—including benefits and retirement. The salaries, benefits and pensions are all controlled by labor contracts. In fact, because of the COVID 19 pandemic, these costs will likely blow up. The Ventura City Council’s control of this expense is limited to reducing staffing levels. Here are examples that the City Council is considering.  There are other costs the Council can influence. It’s time the City Council scrutinizes all the cost of services to consider less costly options. Those services can be General Fund items like fire and police, or they can be other operational items like water.

There are other costs the Council can influence. It’s time the City Council scrutinizes all the cost of services to consider less costly options. Those services can be General Fund items like fire and police, or they can be other operational items like water.

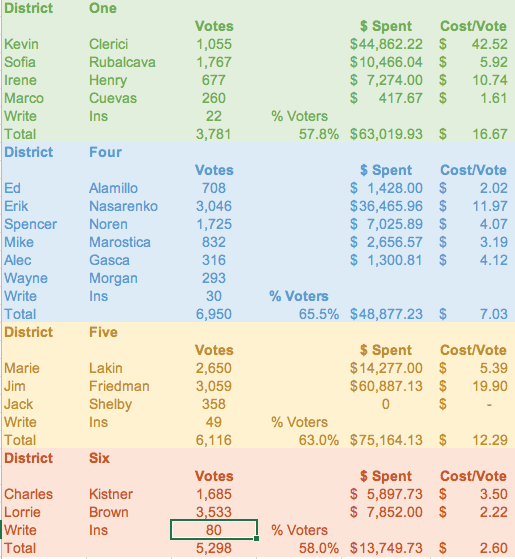

Candidates for the 2020 City Council election must concentrate on the Wishtoyo Consent Decree, and the impact of the decree in the next decade. That Federal Decree requires Ventura to stop putting a majority of its treated wastewater into the Santa Clara River estuary, beginning in January 2025 through 2030. To do so will be an enormous cost to the city.

Candidates for the 2020 City Council election must concentrate on the Wishtoyo Consent Decree, and the impact of the decree in the next decade. That Federal Decree requires Ventura to stop putting a majority of its treated wastewater into the Santa Clara River estuary, beginning in January 2025 through 2030. To do so will be an enormous cost to the city. Ventura Water has confused the City Council by combining two different ideas to falsely heighten the urgency to drink wastewater. In 2011, Venturans were told, “We are short of water.” Ventura Water proposed treating the wastewater we currently dump into the Santa Clara River into potable water at the cost of $1 Billion.

Ventura Water has confused the City Council by combining two different ideas to falsely heighten the urgency to drink wastewater. In 2011, Venturans were told, “We are short of water.” Ventura Water proposed treating the wastewater we currently dump into the Santa Clara River into potable water at the cost of $1 Billion.  Ventura Water will undoubtedly request a water rate increase from this next City Council. They will claim the money is for VenturaWaterPure or to improve the city’s water infrastructure. Water rates already went up by $220 million with water and wastewater increases in 2012-13. Any Councilmember and any candidate for City Council should be able to explain how Ventura Water spent the $220 million and why another rate hike is needed.

Ventura Water will undoubtedly request a water rate increase from this next City Council. They will claim the money is for VenturaWaterPure or to improve the city’s water infrastructure. Water rates already went up by $220 million with water and wastewater increases in 2012-13. Any Councilmember and any candidate for City Council should be able to explain how Ventura Water spent the $220 million and why another rate hike is needed. Ventura has 555 homeless people, according to the 2019 Point-in-Time count. Meredith Hart, Director of Ventura’s Safe & Clean program, believes the 2020 count will be higher. Ventura spends on its homeless are between $3.89-$4.59M per year.

Ventura has 555 homeless people, according to the 2019 Point-in-Time count. Meredith Hart, Director of Ventura’s Safe & Clean program, believes the 2020 count will be higher. Ventura spends on its homeless are between $3.89-$4.59M per year.

Today’s Council is still operating on the 2019-2020 budget that shows everything is fine. In six months we will be in a new budget cycle, how does that look? The city staff projects a “most likely” budget scenario that will have a shortfall of $4.1M. How can the seven members of the City Council take action to save jobs and essential services for the citizens of Ventura?

Today’s Council is still operating on the 2019-2020 budget that shows everything is fine. In six months we will be in a new budget cycle, how does that look? The city staff projects a “most likely” budget scenario that will have a shortfall of $4.1M. How can the seven members of the City Council take action to save jobs and essential services for the citizens of Ventura?

Reduce overtime for city employees. The largest single expense category in the city is staff salaries and benefits. Reducing overtime might save as much as $5.6 million in the budget.

Reduce overtime for city employees. The largest single expense category in the city is staff salaries and benefits. Reducing overtime might save as much as $5.6 million in the budget. Review the money Ventura pays to support the Ventura County Museum. This option will save $250,000 per year.

Review the money Ventura pays to support the Ventura County Museum. This option will save $250,000 per year.  Evaluate Community Granting Programs. The amount of potential savings is not listed. This category includes programs like Community Access Partners (CAPS). CAPS received

Evaluate Community Granting Programs. The amount of potential savings is not listed. This category includes programs like Community Access Partners (CAPS). CAPS received