Latest Exclusive Insider Advice For Council Candidates

“If you don’t know where you are going, any road will get you there.”

“If you don’t know where you are going, any road will get you there.”

—Lewis Carroll

Ask anyone what the pressing issues are facing Ventura; you’ll get a variety of answers. With the unprecedented departure of three serving City Councilmembers, this is an excellent time to get the perspectives of those who have served. Having interviewed the retiring Councilmembers and some former Council candidates, all point to several significant issues facing Ventura’s next City Council in the next few years.

For the first time in Ventura’s history, voting districts divide the city. The districting forced Mayor Neal Andrews and Councilmember Mike Tracy to retire. Councilmember Jim Monahan decided to retire after forty years of service. New Councilmembers will bring fresh perspective and energy to the Council. They also will face a steep learning curve to be effective.

Governing By Districts

City Council Candidates will serve by district

As citizens expect their elected officials to represent their district’s interests, concern for the city as a whole may take a backseat to districtwide issues. That can be a problem when the demands regarding traffic, housing, crime and services of the districts don’t mesh with the other districts’ views.

Nowhere was this more evident than in the first forum for District 1 candidates. Citizens expressed concern for a Westside pool, learning how governing by districts will work, affordable housing and labor force opportunities. Very few of these issues aligned with what the outgoing politicians thought was most important: 1) growth 2) water 3)homelessness and 4) staff accountability.

Governing by districts means inexperienced new Councilmembers will lead the city. Inexperience means two things. First, existing Councilmembers and city staff may marginalize them until they gain experience and knowledge. Second, the new City Manager and the city staff may take more control without voter accountability. Neither of these is good.

More distressing may be the loss of a citywide perspective on the Council. Wrangling for projects will probably intensify. It is likely that Westside swimming pool proponents will battle the Kimball Park proponents over who gets funding, for instance.

Re: Growth

Growth meant different things to each interviewee. All agreed Ventura needed to grow. They also concurred that growth and water availability are inseparable. Each acknowledged the need for affordable housing but recognized the opposition to more houses (the NIMBYs). Forward progress on growth means accommodating, integrating and compromise.

The Solution is Sensible Growth

Growth and water are inseparable—you can’t have one without the other. The next City Council must forge a reasonable growth plan. The new Council will also have to convince the “no-growth” citizens that the city needs to grow to be vital. The Council should also call for the city staff to streamline current fees and permits practices.

Re: Water

Everyone acknowledged water was a concern. The specifics on how to address the issue varied widely, however. The solutions offered by those interviewed included the Heal the Bay Consent Decree, state water, direct and indirect potable reuse and drilling new wells. There was no clear direction.

Solutions for Better Water Management

The new City Council can take three steps to address water. First, they must request a modification to the Heal the Bay Consent Decree to extend the deadline for extracting wastewater from the estuary. Extending the deadline requires the Council to direct the City Attorney to act if Ventura is to avoid penalties for not complying.

The new City Council can take three steps to address water. First, they must request a modification to the Heal the Bay Consent Decree to extend the deadline for extracting wastewater from the estuary. Extending the deadline requires the Council to direct the City Attorney to act if Ventura is to avoid penalties for not complying.

Second, The Council must force Ventura Water to table Direct Potable Reuse (DPR). It is an expensive gamble. No State approved testing exists for DPR today and may not for 4-8 years. California anticipates establishing safe drinking water standards for DPR in 2024, but there are no guarantees they will meet that deadline. There’s no reason to proceed with an untested and unproven method that risks the public’s health.

Third, the Council must make Ventura Water more transparent. The goal is two-fold. Increase accountability within the department and increase communication to the public. As an example of poor communications, most of Ventura did not know of September’s safe drinking water breach. Ventura Water exceeded the Federal Total Trihalomethanes (TTHM) levels. Bear in mind that elevated TTHM levels were the cause of the water issues in Flint, MI. Ventura Water met the minimum requirements for reporting the violation. They contacted the residents in the affected area but did not explain it to the rest of the city. They fulfilled the letter of the law but not the spirit of it. To date, they have not notified the public whether the TTHM levels have returned to acceptable levels.

Re: Homelessness

Housing Ventura’s homeless was a high priority. Some thought affordable housing was the solution. Others mentioned the homeless shelter. Some interviewees distinguished between the mentally ill living on the streets and the vagrants. Each saw it as a countywide problem with Ventura as its nexus. The county jail and the psychiatric hospital are in Ventura, making the city a natural final destination for the homeless to stay. One interviewee described it as a “catch and release” program by the other cities into Ventura.

Housing Ventura’s homeless was a high priority. Some thought affordable housing was the solution. Others mentioned the homeless shelter. Some interviewees distinguished between the mentally ill living on the streets and the vagrants. Each saw it as a countywide problem with Ventura as its nexus. The county jail and the psychiatric hospital are in Ventura, making the city a natural final destination for the homeless to stay. One interviewee described it as a “catch and release” program by the other cities into Ventura.

Consideration Toward Addressing Homelessness

The new Council should distinguish between criminal vagrants and those willing to accept help. We should be willing to help those who help themselves.

Re: City Staff Accountability

All the interviewees wanted more accountability from the city employees. Often the City Council gives the staff too much power to drive the dialog about, and the outcomes of, important issues. Several pointed to the lack of a City Manager contributing to the problem. Incoming City Manager, Alex MacIntyre, will need to address this issue.

Improving City Staff Accountability

The new Council needs to apply critical thinking and be willing to question all city staff reports and recommendations. To do so requires financial literacy. Each Councilmember must study the city budget and Comprehensive Annual Financial Report (CAFR).

The new Council needs to apply critical thinking and be willing to question all city staff reports and recommendations. To do so requires financial literacy. Each Councilmember must study the city budget and Comprehensive Annual Financial Report (CAFR).

Second, the Council should stop accepting mediocre performance from the staff. Stop praising the employees even when they don’t perform. In private, two of the three outgoing Councilmembers say low staff morale is the reason for the gratuitous praise. False praise is not an antidote for low morale, in any case. It may be detrimental to the top performers by cheapening the value of the kudos. The new City Manager should confront the staff morale issue.

Third, the new Council should scrutinize the expenditures on outside contractors. Last year, Ventura spent $30 million. They should be fiscally responsible and look for ways to cut these costs.

What Was Not On the List of Issues?

Pensions were surprisingly not on the list by any of those interviewed. Either they don’t understand the issue, or they feel it is a problem they cannot change, or the fallout from ignoring it is too far into the future.

How to Address Pensions

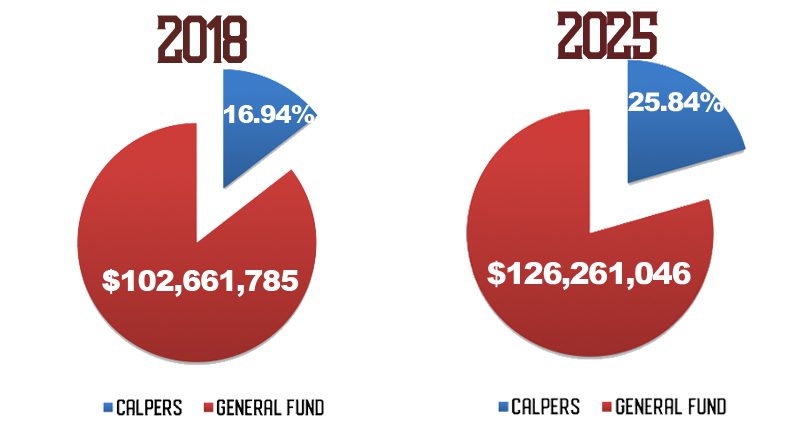

Pensions are the ticking time bomb nobody wants to discuss. They’re the political third rail issue that candidates ignore. Two years into this new administration, the CalPERS payments are going to balloon. It’s time for the city to acknowledge and admit that pensions will consume the Measure O tax increase by 2023. Forecast the anticipated CalPERS increases objectively. Provide the Council with the necessary information to make financial decisions.

Editors’ Comments

Many complex issues face Ventura. All City Council candidates need to be aware of the problems and have a plan to address them. We can’t rely on the candidates alone to be knowledgeable. It’s each person’s responsibility to be aware of the challenges before us. It’s equally important that each voter be confident that the candidates understand them. Only then do our elected officials represent us

Many complex issues face Ventura. All City Council candidates need to be aware of the problems and have a plan to address them. We can’t rely on the candidates alone to be knowledgeable. It’s each person’s responsibility to be aware of the challenges before us. It’s equally important that each voter be confident that the candidates understand them. Only then do our elected officials represent us

Even though voting districts divide the city, our elected Councilmembers must represent the entire community. When deciding on issues, they must think about the city at large. The tendency will be to think about each Councilmember’s district first and the city second. Such a practice is unacceptable to a town of only 109,000 people. We must always remind our elected officials to think of the city before his or her district.

Keep these points in mind as you go to the polls in November

New Council Candidates Will Replace Departing Councilmembers

Below you’ll find the photos of our current City Council. Click on any Councilmember’s photo and you’ll open your email program so you can write directly to that Councilmember.

Let them know what you’re thinking. Tell them what they’re doing right and what they could improve upon. Share your opinion. Not participating in government weakens our democracy because our city government isn’t working for all of us.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

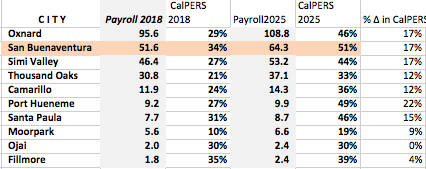

Ventura is already paying 34 cents to CalPERS for every dollar it pays its active employees. In six years, that amount will go up to an unsustainable 51 cents for every dollar of payroll—more than any city in Ventura County. Pensions are already crowding out other essential city services like filling potholes, fixing infrastructure and even hiring more police officers and firefighters.

Ventura is already paying 34 cents to CalPERS for every dollar it pays its active employees. In six years, that amount will go up to an unsustainable 51 cents for every dollar of payroll—more than any city in Ventura County. Pensions are already crowding out other essential city services like filling potholes, fixing infrastructure and even hiring more police officers and firefighters.