Pet Projects Cloud Ventura City Council’s Push For A Sales Tax Increase

“We don’t have a revenue problem, we have a spending problem.” — Ronald Reagan

The Scenario

The Ventura City Council is determined to raise taxes again by putting a measure on the ballot in November to increase sales taxes by 0.5%-1%. Two previous attempts failed. As is customary, they are not completely forthcoming or transparent when they are trying to extract more money from the citizenry. On January 30, 2016, the City Council held a special meeting at the Ventura Police Department whose true purpose was to discuss raising the sales tax. The Council spent $118,000 to hire consultants to sell the voters on a tax increase. What they learned should have disappointed the Council.

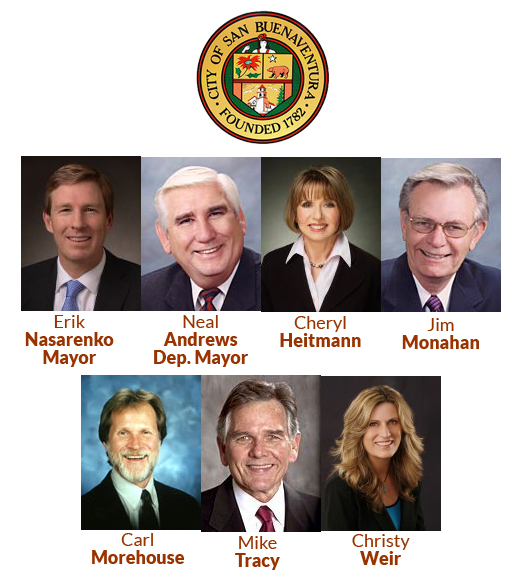

These Councilmembers are pushing hard to put a sales tax increase on November’s ballot.

Confusing Messages From City Councilmen About The Sales Tax Increase

At the January 30th meeting, Deputy Mayor Andrews commented that we are currently in an economic downturn, which is exactly the right time when we as a City should be increasing capital spending. His comment left many in the audience puzzled. If this is indeed an economic downturn, the last thing the average taxpayer wants to do is pay more taxes. More taxes reduce their ability to pay rent or their mortgage. It cuts into their food budget, their travel and vacation capability, their medical care and their own future retirement.

Mayor Nasarenko is campaigning on the premise that Ventura voters will support a locally kept and locally spent tax. He fails to understand, however, that $340 more out of a household budget is still $340, regardless of where and how it is spent. ($340 is City Council’s estimate of how much more each household will pay annually if the sales tax is increased 1%)

Both the Mayor and Deputy Mayor are ignoring nearby failures of sales tax increases, too. Neighboring Oxnard and Port Hueneme increased their sales taxes and they’re still having budget problems. Politicians in those cities failed to realize it is a spending problem, not a revenue problem. Now, Ventura’s politicians are blindly walking down the same path.

Let’s Not Forget Each Councilmember’s Pet Projects

Deputy Mayor Andrews was adamant at the January 30th meeting that Ventura needs more assistance and housing for the “homeless.” Who falls into this category was not defined which leaves it open to interpretation by city officials. It is a fair assumption, though, that one would be able to identify the beneficiaries of his largess by walking down the street. Nothing prevents spending these taxes on any special project such as this once the money goes into the General Fund.

Councilman Morehouse announced last year during a public session that a sales tax increase would just scratch the surface. Both he and Councilwoman Weir consistently argue that an increase in the sales taxes is just a start, and that Ventura, like other cities, should also be seeking more taxes for:

- Median maintenance tax

- Lighting district tax

- Fire district tax

- Recreation district tax

- Library tax

MORE TAXES – THE BIG PICTURE

[PENURY BY THE PENNY]

A sales tax increase is not an isolated event. To understand the full impact of the tax burden on Venturans, one must consider all the other tax increases facing voters.

The Ventura School District tax, approved in 2012, is up for renewal in 2016. Governor Brown’s “temporary” sales tax increase is also up for renewal. And, Ventura County Transportation Commission is considering a sales tax, countywide.

Then consider other recent tax increases:

Medicare tax went from 1.45% to 2.35%

Income Tax rate went from 35% to 39.6%

Payroll tax went from 37.4% to 52.2%

Capital gain tax went from 15% to 28%

Dividend tax went from 15% to 39.6%

Estate taxes went from 0% to 55%

Real Estate transaction tax of 3.5% was added

There’s An Alternative Plan The City Council Refuses To Consider

Our City government has $20 million more in real property taxes and sales taxes. Add to that the 34% water rate increase, imposed without your affirmative vote, to raise millions to fund and replace the water and wastewater infrastructure under our streets, it becomes clear that city government has enough money.

Our current City Council wants more tax money, calling for citizens to “invest” more of “your money.” Ask yourself first how they have invested “your money” over the last 8 years, and the answer unequivocally — poorly. How about showing us first how they manage the tax money they have before demanding more.

If you agree that Ventura should live within its existing budget, then write to your City Councilmembers to say so. Tell them not to tax Ventura citizens any more and to spend the money they have more wisely.

Click On A Councilmember’s Photo To Send Them An Email

Editors:

R. Alviani, K. Corse, T. Cook, R. Berry,

J. Tingstrom, R. McCord, S. Doll, C. Kistner,

W. Frank

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Leave a Reply

Want to join the discussion?Feel free to contribute!