The Inclusionary Housing Mirage

Some People regard private enterprise as a predatory tiger to be shot. Others look on it as a cow they can milk. Not enough people see it as a healthy horse, pulling a sturdy wagon. —Winston Churchill

ELIMINATION OF THE INCLUSIONARY HOUSING ORDINANCE

[A PRO-GROWTH PROPOSAL ]

The Ventura City Council, at their meeting on Monday, July 15, 2013, will consider the recommendation of our new City Manager, Mark D. Watkins and Community Development Director, Jeffrey Lambert, “to eliminate (cancel) both the Citywide and Downtown Inclusionary Housing Ordinances (IHP)”.

This ordinance was adopted in August, 2006. The author was Councilman Brian Brennan. The idea was that there are people in the City who “need housing”, and cannot afford to buy or rent housing unless they received financial assistance. So, on a vote of 5 to 2 it was decided that if a person or company wanted to build 15 or more residential units “for sale” or “for rent” then that developer, at their expense, was required to donate a percentage of the living units to low income people. The units had to of the same quality and disbursed throughout the project.

“The adoption of an inclusionary housing requirement in conjunction with the Housing Approval Program, will provide a mechanism for all residential development containing 15 or more units to provide ‘their fair share’ of affordable housing…” Resolution No. 2006-058

Now, 7 years later, it is clear that the concept is not working. The “developers” have not stepped forward, they have declined to invest and build the projects in the City and new construction has stalled. Our new City Manager and the Community Development Director are recommending that this ordinance be cancelled. The full report can be read on line as agenda item 14 for the Council meeting of June 17, 2013.

“It is staff’s recommendation… based on the State Department of Housing and Community Developments conclusions that IHPs are a constraint to the development of housing. In addition, staff believes imposing this obligation to provide affordable housing units on market rate developments places an undue burden on these developments and increases the cost of market rate units…”

—Administrative Report, May 29, 2013

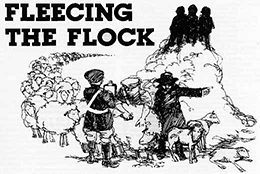

THE SOCIAL EQUITY ARGUMENT

[EVERYONE IS ENTITLED TO AFFORDABLE HOUSING]

Some will protest eliminating the Inclusionary Housing Ordinance.

Opponents to the proposal to eliminate this ordinance will be very visible and vocal in their opposition at this City Council meeting. They will demand that the council reject the staff recommendation, because everyone is entitled to affordable housing, and that housing “for sale” or “for rent” can be provided to those in need without spending public money. Their logic is that tax payers will not have to pay anything because the developer will have to pay. Alternatively, they ask that if this is not acceptable then the developer should pay an “in lieu of fee” of $200,000 or more.

This argument will find a sympathetic ear in Councilman Brennan. No surprises. He authored the original concept, proselytizes “social equity”, and is strident in this view that affordable housing for all (free or pay what you can afford) is an unassailable truth – if you cannot afford housing then is somebody else will have to pay.

A READER’S VIEW

[THE BURDEN WILL FALL ON PROPERTY OWNERS]

A reader and property owner, who expressed a desire for anonymity, stridently supports the efforts of the City Council to abolish or severely restrict the current inclusionary housing program. In our view “we can think of no other program which so seriously restricts private developer efforts to build housing in Ventura as well as seriously impacting our revenue base of property tax”.

Affordable housing mandates have had an unintended consequence: they have discouraged home building, and the diminished supply of housing has driven prices up.

The opponents of the change ignore the fact that almost 40% of Ventura’s housing stock is already dedicated to some form of subsidy for affordable housing, leaving 60% to pay the bills of the City. Advocates of affordable housing seem to have no concept of economics, and feel that someone else should pay for their housing costs.

In 2008 the Independent Institute published an article on the subject http://www.independent.org/newsroom/article.asp?id=2225 which is instructive. Extracts from that article are quoted below.

“We recently analyzed how inclusionary zoning laws, requiring builders to set aside a given percentage of new construction for low- to moderate-income individuals, have affected both new home prices and the quantity of new homes over time.

We compared the changes in housing prices and supply in these cities to those without a similar ordinance. The cities that adopted inclusionary zoning laws saw a 20 percent jump in housing prices and a 10 percent decrease in the number of new units built. This is the basic law of supply and demand at work. Affordable housing mandates have had an unintended consequence: they have discouraged homebuilding, and the diminished supply of housing has driven prices up.

Despite the nice-sounding name, inclusionary zoning is still a price control that leads to a decrease in the amount of housing. Economic theory and evidence demonstrate that imposing price controls and taxes on housing is one of the worst ways of encouraging the production of housing.

The real problems causing the affordability crisis are regulations that prevent increases in the supply of homes. Eliminating restrictive zoning regulations will give consumers more choice and make housing more affordable. For those who truly care about making housing more affordable, price controls are not the answer.”

ANOTHER PERSPECTIVE – THE ARCHITECT/PLANNER[1]

One architect expresses concerns over the Inclusionary Housing Ordinance

The real challenges I encounter regarding inclusionary housing ordinances are around the issue of for-sale homes and financing. For the developer, inclusionary housing requires them to write down or subsidize the cost of the affordable units. The ordinance assumes that the project has enough profit margin to allow this to happen, but as demonstrated in the last several years, there is no guarantee that this will be the case.

From the low income buyer qualifying for a the low income housing is problematical. The IHP assumes that the low income home buyer can qualify for the loan, of even a subsidized amount. That is an enormous hurdle, but even if they can qualify such projects will have association fees of hundreds dollars per month. These costs cannot be written down as they must be paid by every member-owner of the association.

The intent of the IHP is positive – trying to keep new development from overwhelming existing smaller scale neighborhoods. But the matter of affordability works in direct opposition to this intent. The City has recently been trying to meet these challenges and has been moving to adjust interpretations to make the situation more workable. Not everyone knows or appreciates that effort.

Problems notwithstanding finding ways to provide affordable housing in the Downtown area, for both rental and purchase housing, is a laudable goal. To provide smaller more affordable market-rate dwellings, such as studio and loft-type apartments, ranging from 400 sq.ft. to 600 sq. ft. will meet a real need. These can be very nicely done and are popular dwelling-types for our younger Venturans, who are drawn to the downtown as a place of social and cultural interest. Many are employees of the variety of businesses – restaurants, retail shops, professional and service businesses.

Editors’ Comments

The State of California Department of Housing and Community Development, our City Manager and Community Development Director advise that this ordinance should be cancelled because it is not working. We should listen. This ordinance has not only failed in its stated objective, but has in effect stalled housing growth.

Your letters and comments on this issue are extremely important. Send emails to Ventura Mayor, Mike Tracy mike.tracy@cityofventura.net

Editors:

B. Alviani K. Corse T. Cook

J. Tingstrom R. McCord S. Doll

[1] Opinion provided by a longtime Ventura architect.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.