Is Ventura Poised To Commit Another Real Estate Blunder With The Trade Desk?

“ONLY THE MEDIOCRE ARE ALWAYS AT THEIR BEST”

—Jean Giroudoux

WILL VENTURA CITY GOVERNMENT EVER LEARN?

It’s déjâ vu all over again. Once again the past rears its ugly head. Only this time will the City Council be wise

Is The Trade Desk real estate deal a gift of taxpayer money to a private company?

enough to learn from its past mistakes? There are some things this Council and this city staff are not qualified to evaluate fully.

Among the first issues facing the 2017 Ventura City Council is a real estate transaction. Ventura is selling four parcels of City-owned, prime downtown public property. The properties for sale are at 535 East Main Street.

The fact that the City is pursuing the sale of surplus land is commendable. Selling these properties should be open and transparent. To do otherwise, invites the possible perception of favoritism or mismanagement of public funds. Proper evaluations, bidding and screening needs to happen.

CITY STAFF PROPOSES A NEW DEAL

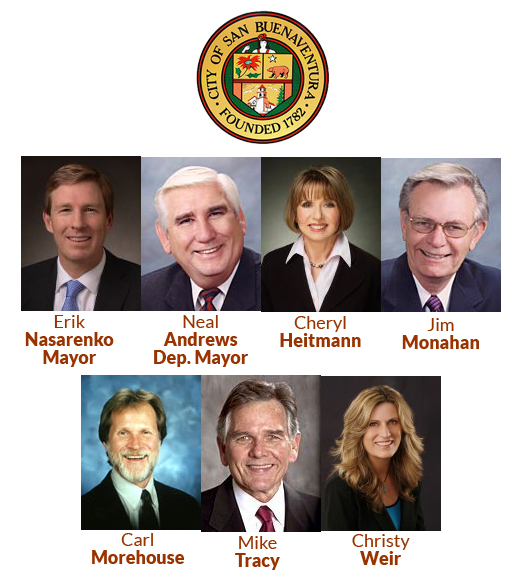

Community Development Director, Jeff Lambert, presented a new real estate deal on November 15, 2016. He asked the City Council to approve the sale of a large, downtown city parking lot. The proposed buyer is a company called The Trade Desk. The Trade Desk wants to build a headquarters office building. The proposed offer was $1 million ($24 dollars a square foot).

City staff steered the selection of The Trade Desk as the sole qualified bidder. The City Council depended upon the recommendations of City Staff.

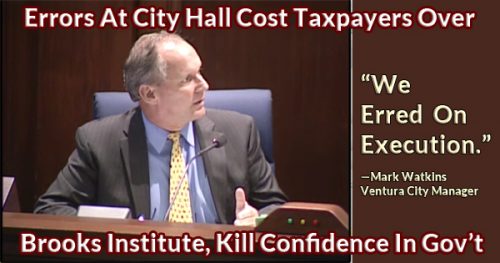

Four months earlier, the City Council relied on city staff’s recommendations on another deal. The city staff did an incomplete analysis before recommending the Brooks Institute project. They compounded this mistake by failing to collect deposits and rent. The Brooks Institute deal fell apart.

This time, the City Council was close to selecting The Trade Desk in another real estate deal. They almost decided without benefit of an independent financial analysis or a professional appraisal.

WHY THE TRADE DESK?

The Trade Desk is a Ventura success story. Does that entitle the company to favorable treatment from city government?

The Trade Desk is a success story many citizens do not know about. The City of Ventura funded an incubator business startup program. They used $5 million of taxpayer’s dollars to seed the fund. The Trade Desk was a beneficiary of the subsidized program. The Trade Desk is a large tech company that brought new jobs to Ventura. The company achieved early success. With their success, the Trade Desk went public and the stockholders have made millions. A true success story for Ventura.

The Trade Desk wants to enjoy the city’s largess, again. This time, they want to buy city property for their headquarters at below fair market value. Their business success should not cloud City Hall’s judgment. City Hall should not sell public property at a discounted price.

DOES THIS DEAL PASS THE SMELL TEST?

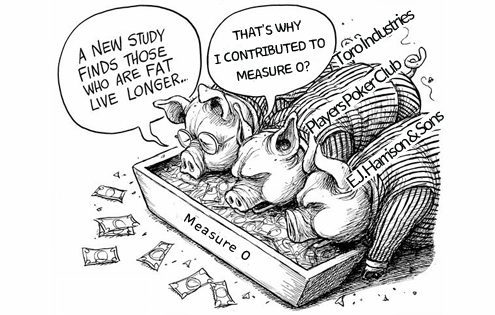

A first whiff of impropriety surfaced during the election. The Trade Desk donated $7,000 to support the successful city-backed ½¢ sales tax measure.

Another whiff arises with regards to the questions the city asked to approve The Trade Desk. A close examination of the specific judging criteria reveals the questions were subjective.

Of the three bids submitted, city staff selected The Trade Desk as the most qualified bidder. In its proposal, The Trade Desk offered $1,000,000 in cash for the properties.

The city purchased the properties for $618,000 in 1997. The city valued the properties at $1,684,000 in the original proposal. They base their estimate on a 6 year old value (10/25/10) comparable price for a city parking lot. The city’s valuation is $40 per square foot.

A QUESTION FROM THE AUDIENCE SLOWED DOWN THE PROCESS

The third impression of impropriety is how much the city valued the property. The city valued the property at $40 per square foot based on a 6-year old comparable property. In the same council meeting, city staff urged the Council to buy another parking lot for $64 per square foot. City staff recommended buying the parking lot for $64 per square foot. This established a new comparable price. The new comp values the parcels at 535 East Main Street at more than $1,684,000.

The City Council seemed oblivious to the conflicting valuations. A citizen in the audience brought it to the Council’s attention. Only then did the City Council call for an independent appraisal.

It’s a mistake to sell The Trade Desk these downtown lots for $1 million, when the true value is closer to $2 million.

GIFT OF PUBLIC FUNDS?

You decide if The Trade Desk real estate deal is in Ventura’s best interest.

The city staff recommended to City Council to sell the property at a price below market value. This is another real estate blunder the staff made in 2016. In essence, it would be a gift of public money through the sale of property for less than market value. The sale would enrich The Trade Desk’s shareholders on the back of Ventura’s taxpayers.

The final whiff of impropriety appeared in the handling of the finances. Ventura city staff was willing to accept $50,000 in escrow from The Trade Desk. The Trade Desk estimates it will spend $15 million to develop the property. The deposit works out to 0.3% of the total value of the project. Such a small deposit amount should have concerned city staff. One would think they would have learned from their prior mistakes. Not accepting an adequate deposit was a pitfall in the Brooks Institute situation.

EDITORS COMMENT

MOVING FORWARD RECOMMENDATIONS

Negotiations continue with The Trade Desk. Yet, the openness and transparency of this transaction remains in question.

To avoid any appearance of impropriety, Ventura should request new proposals for the property. The city must get an appraisal by an independent, certified commercial real estate appraiser. The sale price must be equal or higher than the appraised value. The city must make new bids public. And the final offer must generate a better return to Ventura’s citizens.

The successful bidder should make a good faith, earnest deposit. In the event the transaction doesn’t move forward, a deposit protects Ventura’s citizens. The deposit would cover any loss of value or cost to return the property to its current state.

Editors:

R. Alviani K. Corse T. Cook B. Frank

J. Tingstrom R. McCord S. Doll C. Kistner

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.