Busting Ventura’s Budget Myths And Fantasies

THE TRUTH IS IN- CONTROVERTIBLE, MALICE MAY ATTACK IT, IGNORANCE MAY DERIDE IT, BUT IN THE END THERE IT IS

—Winston Churchill

PENSIONS BUST BUDGETS

[Grappling with Money and Economic Reality]

The City Council race concluded with the reelection of Councilmen Andrews, Monahan and Tracy plus a new councilman, Eric Nasarenko. Our new Councilman was elected as Deputy Mayor at the last Council meeting and will serve in that capacity next year. We congratulate each member of the Council.

During the election campaign these candidates asked to be elected so that they could help to bring about changes in City policies to:

- improve the development of business

- create and maintain parks

- seek to improve streets

- finance libraries

- find ways to provide housing for lower income citizens

- improve the gateways to Ventura on the North and South of Highway 101

- create a more favorable regulatory structure to encourage development of housing

- improve services to our citizens.

One thing that stood out for all four of these Councilmen was their plea that if the voters returned them to office and elected Mr. Nasarenko then a newly constituted Council could and would be more cohesive, and bring about the promised changes.

Their promise of change is laudable, but nothing can or will be accomplished without the money and revenue to realize those changes. That objective requires sound financial planning—an accurate and realistic budget with realistic income and expense projections.

From Where Will The Money Come In This Year’s Budget?

On June 17, 2013 the old City Council was presented with a Proposed Budget for 2013-2014. They were shown a power point presentation, explained by our City Treasurer, which was based upon a printed 569 page budget book submitted by our City Manager, Mark D. Watkins, on April 23, 2013. This budget was approved on a vote of 6 to 1 after a 30 minute hearing. Nobody from the public appeared to comment.

It’s hard to overcome a $1.6 million deficit, if this year’s budget has no new revenue items.

Council members asked few questions, but did make statements “for the benefit of the television public” concerning their views on this budget. Nobody asked any questions about the projected income, or questioned the expenses in this complex document other than Councilman Andrews. He voted “no” on the motion to approve a budget projecting a deficit of $1.6 million in our next fiscal year (July 1, 2013-June 30, 2014). He explained his no vote – “We have cut too far and we need to look at public safety costs (police and fire pension benefits)”, meaning that the Council needed to look at ways to address the enormous pension costs before considering anything else such as new taxes.

Two Council members made statements that the general fund be unburdened by shifting some costs from the general fund to special tax assessment districts — taxes on real property. Councilman Morehouse wants to shift a $500,000 public lighting cost to property owners, although conceded, when asked by Mayor Tracy, that this might also be funded by increasing sales taxes. Councilwoman Weir commented at length about the special assessment costs imposed by other cities, such as Camarillo and Oxnard, for street repair, landscape maintenance, parks, public safety and libraries. It was clear from these comments that their solution for our City deficit is to tax our way out of it.

Where’s The Transparency In The Budget?

This published budget is long, complex and difficult to read. It consists of real number-clots, number slabs by department and sub-department(s) with pages of swimming line items in minute detail. It is difficult to read, interpret or understand as a financial planning document. For example, members of VREG tried to determine how the projected income was calculated, and what the public pension costs (the largest item in the entire budget) would be for the next fiscal year. The income information could not be found. The pension data was sprinkled throughout all 589 pages and explained by esoteric line items and number for every department. The City Treasurer was asked about the complexity of this document. He conceded that this was the equivalent of a “data dump”. A good management tool for a City Council it is not.

Focusing first on the income side. The City Treasurer at the June hearing projected income of $86.7 million. This is $4.3 million more than was collected in 2012-13, an increase of 5.2%, twice the estimated U.S. Gross Domestic product estimate of 2.5%.

No explanation has been given on where this new source of revenue will come from. That question was put to one candidate during a candidate forum in October. A citizen asked, “What plan does the city have to grow their revenue by that amount of money?”

The answer was revealing (click on the quote to see video of his answer):

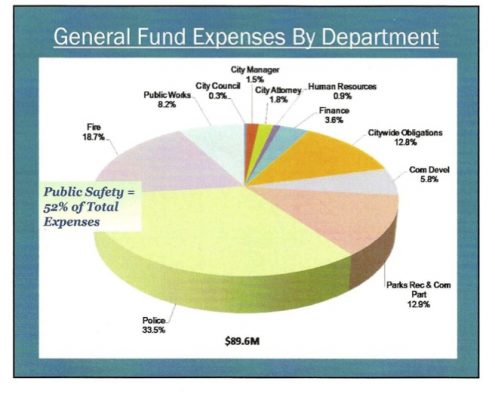

There is a $1.6 million deficit in this year’s budget. As a higher percentage of Ventura’s General Fund is spent on police and fire pensions, less revenue is available for other services.

The projected deficit of $1.6 million and sagging income expectations are bad The annual cost of salaries and benefits for public safety — police and fire — is bad, and will grow to fifty-two (52%) of the total general budget in the next fiscal year

Unfunded Pension Liability Is Staggering

Then there is the matter of how much will have to be paid to CALPERS to pay the unfunded pension obligations of City employees, police and fire personnel in addition to the annual operational costs. In 2008 those unfunded obligations totaled $48 million.

In October, 2013, CALPERS reported that the market cost of those unfunded liabilities have increased by 360%, and as of June 30, 2012, totaled $173,412,464. CALPERS also added a note in that report that if the City wanted to terminate our contract with CALPERS it would cost us $600,421,434.

This is only going to get worse because CALPERS has announced it will consider adjusting (lowering) its expected rate of return in 2015 by 1/4%, and that the actuarial life of public safety personnel is not shorter than the average person, as previously assumed, but is the same. That means these pensioners, starting at age 55, will get paid benefits over a longer period of time.

Cities nationwide are grappling with the growing retiree-benefit pension costs which are eating up more of city general funds. That leaves less money to spend on parks, libraries, maintenance of trees and parkways, street lights and an asundry of public service projects. Ventura is not alone. As a higher percentage of a City’s general fund is spent on police and fire pensions, less revenue is available for other services and projects. Detroit, Stockton and San Bernardino are models of cities that refused to accept economic reality.

If the total unfunded obligation cost does not get the attention of our new City Council, then perhaps the most recent CALPERS Actuarial Valuations predicting our annual payment obligation will get their attention. In 2013-14 the required annual contribution total will be $8,530,730. In 2014-15 the required payment will increase to $9,489,593. That is more than $1 million more to be paid out of the General Fund

Editors’ Comments

Why there are no protests by the citizens of Ventura for changing the pension plan of public safety personnel? What will it take to get Venturans excited and concerned about this problem?

When the question of pension reform was presented to our City Council members in the past the traditional answer was that this problem could only be addressed on a statewide level; Ventura will not be the “lead dog” and venture out into this new territory; and, as unfounded as it may be, that Ventura would no longer be competitive in hiring the best employees.

This unfunded obligation to public safety personnel is a budget buster. Nobody wants to make a decision. In the meantime, Ventura will reduce services, charge more fees (or taxes) from its citizens and ignore the obvious “train wreck” that is ahead because it either lacks the leadership or vision to act responsibly for the future of this City

All the campaign promises in the world are worthless unless and until this new Council establishes a realistic budget, and finds real solutions to our public pension obligations. Trying to tax ourselves out of debt is not a solution. Requiring greater employee contributions to their own retirement (8 – 10%), and creating a defined contribution plan for new hires will solve the problem in time.

That is why you were elected!

Editors:

R. Alviani K. Corse T. Cook

J. Tingstrom R. McCord S. Doll

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.