Budget and Pension Crises Throughout California Inflict Harm

“If there must be trouble, let it be in my day, that my child may have peace”—THOMAS JEFFERSON

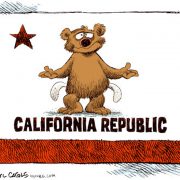

CALIFORNIA – A FAILED STATE

[THE “TERRITORY OF CALIFORNIA”]

You can watch the stock market successes, listen to the pundits braying out messages like “we have turned the corner”, but the reality is that the State of California and the municipalities nationwide, including the City Ventura, are in trouble.

The recession caused budget and pension crises throughout California.

The fortunes of the State of California are grim. The S&P and Fitch Investors lowered the debt rating on General Obligation bonds to BBB. This rating means that California bonds now are “speculative with major risk exposure”. It is projected that the rating will be lowered to B (junk bond), which means “adverse business, financial, or economic conditions will likely impair capacity or willingness to pay interest and repay principal”.

During a VREG forum at the Ventura Beach Marriott on February 24, 2010, the guest speaker, Chriss Street, of Orange County whistle blower fame, currently serving as the Orange County Treasurer and Tax Collector, put the State of California with the debt problems of Greece, which imploded because of their governments “credit default swap” ventures. They and the State of California are broke, but our state does not have a Eurozone to bail us out. It is so bad that the Governor’s office is looking at bankruptcy. By law, a state cannot file bankruptcy, but state government has been advised that bankruptcy is an option if they convert to a “territory”.

Mr. Street also was of the opinion that between July 21 and July 24 of 2010 the State of California will be in the position of being unable to obtain any financing to continue operations. Is he right? We do not know but we have marked it on our calendars.

VENTURA’S CUPBOARD –ALMOST BARE?

[IN THEN JUST OUT OF THE PICKLE BARREL]

The economic failure of the State will have a direct effect on municipalities including the City of Ventura. Recall, that last year our state government, pursuant to Proposition 1A decided to “borrow” [take] our real property tax money. They can do that for two years with a promise to pay it back. This served as a major argument by Mayor Weir, Councilman Fulton and the “TAX ‘EM” bunch to convince Venturans to raise the sales tax. Didn’t work the first time in 2006 and it cost the citizens a bunch of money again in 2009.

California withholds property tax revenue from Ventura to close budget gap.

Then, after the November election we learned that the City did get the real property tax money through a concept of “securitization”. Here is a hopefully simple explanation. As part of the 2009-2010 budget, the California Legislature suspended the local agency protections of Proposition 1A and passed a provision to withhold more than $2 billion of property tax revenue from cities, counties and special districts. Ventura’s share of that was $2,718,041. So, in a plan equivalent to a “forced loan”, the State exercised the right to hold those funds to close the budget gap, with the intent to repay the money in three years. As an alternative, the legislature also permitted the establishment of a third-party securitization program for cities to use to avoid the loss of revenue. A group called the California Communities Development Authority (aka California Communities) was appointed as the exclusive authority to offer a program to purchase the receivables due to local government agencies from the State. They did that, $2 billion in bonds were sold in the market place and the property tax money due to each municipality was paid with all interest and costs paid by the State. View the amount taken from each city/county here.

The City of Ventura again faces the specter of losing this same amount of money in the 2010-11 budget. Given the deplorable condition of the State finances one wonders who would again loan the State another $2 billion. On a positive note the City of Ventura has joined with the California League of Cities in signing a referendum petition to prevent the State of California from taking the real property tax money in the future. Our city is sitting on the edge of the proverbial pickle barrel.

THE $11 MILLION PROJECTED BUDGET LOSS

City employees are the largest budget expense in Ventura.

On March 15, 2010 Mayor Fulton invited community leaders to attend a BUDGET WORKSHOP to help decide where to make cuts in the 2010-11 budget to compensate for an $11,000,000 PROJECTED LOSS. Liberally attended by policemen and fireman, due to invitations extended, by our Chiefs of Police and Fire, to “Friends of the Fire Department” and “Friends of the Police Department”, the participants came up with a variety of proposals. The giddy report from Mayor Fulton was that it was a resounding success, with proposed solutions like – “muddle through”, “strategic layoffs”, “use of volunteers”, “delay projects” and “shift funds”.

One participant reported that during this conference the major budget item that needed to be addressed was all but ignored, which is the cost of people. At least 80% of our expected income of $85 million will be spent for people and pension costs. Police and fire consume 56% of the total budget cost.

EDITORS’ COMMENTS:

The original budget was based on a prediction that the City would have income of $97 million to cover their expenses. It was a bad bit of guess work. Realistically, the City could never have expected more than $85 million in the first place, however now they want the citizens of the community to believe they have an $11 million shortfall. Not true. What they have is long-term expenses of $11 million more than their income.

THE PENSION DEBACLE

A few months before the November 3rd election the City Council proudly announced that the City Council, in an effort to address serious budget woes, had appointed a special committee to investigate potential reform of the salary and benefits paid to the City public employees, and particularly police and fire. They did that and here are the folks appointed to come up with a recommendation:

| Vern Alstot | Fire Management |

| Neal Andrews | Councilmember |

| Bart Bleuel | Public Member |

| Eric Burton | Code Enforcement officer |

| Benny Davis | Fire Department |

| Ramon De La Rosa | Maintenance Department |

| Quinn Fenwick | Police Management |

| Randy Hinton | Public Member |

| Sylvia Lopez | City employee union representative |

| Frank Maxim | City employee and supervisor |

| Ed McCombs | Public Member (former City Manger) |

| Jim Monahan | Councilmember |

| Richard Newsham | Union representative |

| John Snowling | Police officer |

| Mike Tracy | Councilmember |

This group did not come up with a recommendation. On Monday, March 22, 2009, they disbanded and submitted a report to the Ventura City Council. The report consists of a compilation of different views including position statements of the nine (9) union and employee representatives.

To their credit the City Council received the “report” then unanimously voted to adopt a “policy” whereby in all future salary and benefit negotiations with the unions and employees the City Council would seek a two tier retirement benefits system, plus ask the policemen, firemen and other employees to pay one-half of the pension contribution requirement. Nothing was accomplished other than to state publicly that in future contract negotiations the City would seek to establish a two tier system.

THE PUBLIC EMPOLYEE PENSION DEBACLE

[THREE CANARIES IN THE MINE]

A reporter named Ed Mendel wrote an article on January 25, 2010 for the San Diego Tribune. Here are few of his comments:

![]()

“A wave of higher pension costs is hitting California’s three major coastal cities, prompting proposals to shore up future budgets with ballot measures in Los Angeles and San Francisco and eroding progress in San Diego, once dubbed “Enron by the sea.”

The surge from an historic stock market crash, which punched big holes in pension investment funds, is creating concern that pension benefits approved in better economic times are not “sustainable” and need to be cut for new hires.

City council members in Los Angeles and San Diego have mentioned the possibility of “bankruptcy” in remarks to reporters this month, a path taken by the city of Vallejo two years ago when labor costs consumed most of its budget.

Labor unions, agreeing to benefit cuts in some cases, are trying to figure out whether current pension levels are unaffordable and should be reduced, or if city officials are overstating the problem to use the economic downturn as leverage for givebacks.”

Vallejo, CA delcares bankruptcy following bad budget management

The City of Vallejo filed bankruptcy because 70-80% of their general budget was devoted to paying police, fire and other public employee salaries and benefits. When the old port city on the far side of San Francisco Bay filed a rare municipal bankruptcy in May 2008, there was speculation about whether bankruptcy would become a way for deficit-ridden cities to shed crushing retirement debts. In a precedent setting ruling in the Vallejo case, U.S. Bankruptcy Judge Michael McManus in Sacramento decided that city labor contracts can be overturned in bankruptcy, and then dissolved the contract.

In the shadow of this decision the Vallejo firefighter union agreed to cut pensions for new hires to 2 percent of final pay for each year served at age 50, down from the current 3 percent at 50, a previous trend advanced by state legislation a decade ago. They also agreed to a new two-year contract with no pay raise and increased their pension contribution to 13.4 percent of their pay, up from 9 percent..

EDITORS’ COMMENTS:

Given the serious budget issues we hope the Ventura police, fire and public employee unions are paying attention, and do not continue to believe that they have found the golden goose.

Editors:

B. Alviani S. Doll J. Tingstrom

K. Corse B. McCord T. Cook

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.