Ventura City Government Gives Citizens Few Reasons To Trust Them

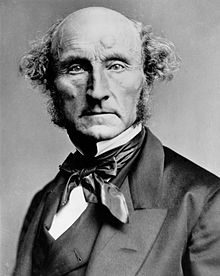

“The most cogent reason for restricting the interference of government is the great evil of adding unnecessarily to its power” —John Stuart Mill

Keeping Track Of Lost Opportunities, Revenues and Unnecessary Expenses

With the passing of sales tax increases in Oxnard and Port Hueneme, it will come as no surprise to Venturans that our city Council will take this as a signal that it is time to attempt to impose a new sales tax increase again in Ventura. If citizens read the Ventura County Star article of November 9, they should catch the reason why Ventura’s tax failed while others passed.

Lack of Trust Killed P6

The operative word is TRUST. The City of Ventura has been determined and relentless in their effort of to unilaterally impose new taxes, in the form of fees, regardless of the wishes of the citizens of this community. It seems clear that we are not in charge of our own community and are to be punished for having the audacity of not approving a sales tax increase in 2006.

Financial Failures Killing Trust In City Government

Here are some examples of how this City Council has been attempting to increase revenues at the expense of Venturans:

| Increased taxes or increased fees: | |

| 911 Phone tax | $2.2 million per year, estimated |

| $10 Fee to process a Business License | $40,000 per year, estimated |

| $99 Hillside weed abatement inspection fee | $250,000 per year, repealed |

| $140 Toxic Waste disposal fee on restaurants | $200,000 per year, estimated |

| $100+ fee on all restaurants for beach clean-up | $150,000 per year, estimated |

| ¼% Sales tax increase (Measure P6) | $6 million per year, failed |

| User fee increases in 2004-2006 | $500,000 per year, estimated |

| Safe Beaches fees $133 per business | $266,000 per year, estimated |

| SUB-TOTAL OF FEES/ATTEMPTED FEES | $8,206,000 |

| Loss of new businesses or loss of existing businesses: | |

| Ventura County Star moves to Camarillo | $0, estimated |

| Harbor Development — 10 years in planning | $0, estimated |

| Seaward and Harbor Development | $0, estimated |

| Failure to complete Olivas Park Road to Auto Center | $4.0 million, estimated |

| Harbor and Figueroa — Embassy Suite Hotel | $2.0 million, estimated |

| SUB-TOTAL LOST REVENUE | $ 9,000,000 |

| Inaction, indecision or bad decisions by city gov’t. |

|

| Waste Water Discharge penalty imposed by State Water Control Board | $733,000 |

| Wal-Mart lease – annual loss of sales taxes | $600,000 per year, estimated |

| State Water Contract – annual cost | $895,000 per year |

| Helen Yunker legal defense costs | $500,000, estimated |

| Legal expense in Ventura v. Tolman & Wiker, low income housing dispute | $800,000, estimated |

| Staff costs to track/ resolve 911 refunds issues | $65,000, estimated |

| 33% increase in retirement pensions for Firefighters | $1.2 million per year, estimated |

| Cemetery Park Beautification Plan | $4.0 million, estimated |

| Viewscape Consultant | $110,000 |

| Use of out of town architect(s) for review | $1.0 million, estimated |

| Victoria Avenue narrowing project | $322,332 |

| Solar compactor Trash can | $ 4,500 |

| Failed Computer System 2005-2006 | $1.7 million, estimated |

| New Computer Program | $800,000, estimated |

| Annual Living Wage Implementation for public contracts | $171,000, estimated |

| City personnel cost to pursue P6, the failed sales tax increase initiative | $ 40,000* |

| New City Attorney salary increase | $ 85,000 per year, estimated |

| Buyout of old City Attorney Contract | $150,000, estimated |

| SUB-TOTAL OF OTHER EXPENDITURES | $13,175,832, estimated |

| GRAND TOTAL | $30,381,832, estimated |

The Cost of Trust Measured In Dollars

Missed opportunity and bad judgment contribute to citizens’ lack of trust in city government.

When you total this all up, there is over $30 million in lost revenue, new taxes, new fees or expenditures that combined would have eased the City budget greatly from wanting to tax the citizens further.

One third of this total is in lost businesses for our community directly attributable to the City Council’s failure to direct city staff to actively process new economic developments and opportunities in an expeditious and cost effective manner.

Then there is the collateral impact of such fiscal mismanagement. Consider, if you will, the impact of projects which failed and/or were not built because of inaction by the City Council and the staff, which resulted in loss of property taxes which were needed to support the Ventura Unified School District. Property taxes would have been collected from the Harbor Development marina, Seaward and Harbor Development, Olivas Park Road-Auto Center development, the Harbor and Figueroa- Embassy Suite Hotel property, the old Ventura County Star site and a fully leased K-Mart property. Forty percent (40%) of those taxes would have been spent on the children of this community.

EDITORS’ COMMENTS

Citizens are now being actively polled to see if they will agree to a ½-cent sales tax. We predict the reversal of the 911-tax blunder, and that our politicos will then spin this as a “carrot” to persuade a yes vote from the voters on a new sales tax. See this for what it really is, a threat of fewer services unless we tax ourselves further. Please review the way our City Council has conducted business in the past, and ask yourself one question- “Do we TRUST them to continue to make more decisions on how they manage our community and spend our money in the future?”

Editors:

B. Alviani S. Doll J. Tingstrom

K. Corse B. McCord T. Cook

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.