Budget Manipulation Using Fiscal Sleight Of Hand

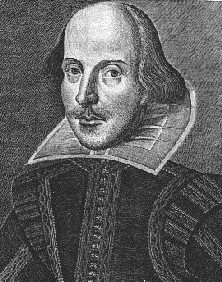

Fair is foul, and foul is fair: Hover through the fog and filthy air”

—Shakespeare, Macbeth

STATE OF THE CITY TREASURY

[TRANSPARENCY THROUGH FOUL AND FILTHY AIR]

History continues to remind us that to get to the root of any act of wrongdoing, malfeasance or wrongdoing, you need only follow the money to find the culprit(s). Eventually the truth and they are revealed. That again proved true at the City Council meeting on March 11, 2013.

Balancing the budget through financial sleight of hand

Our acting City Manager, Johnnie Johnson, in collaboration with the Chief Financial Officer, informed the City Council that those in charge of the budget in our City had adjusted [manipulated?] the GENERAL BUDGET to make it appear that we had achieved a balanced budget. In fact just the opposite was true.

The previous City Manager, Rick Cole together with Mayor Bill Fulton continuously publicized the fact that “we were living within our means”, that “we had balanced our budget” and that our “financial affairs were transparent”. On this Monday night the Council learned otherwise.

What the Council learned is that the $12,000,000 in financial reserves, created in 1992, and still in existence as of 2007, was now in fact only worth $4,300,000. The explanation provided is that Internal Service Funds (noted below), which contained money budgeted and set aside to meet real and specific future costs and potential liabilities, had been reduced so as to make it appear as if the budget had been balanced:

- ($2m) Unassigned.

- ($2m) Unfunded Workers Compensation liability

- ($3m) Potential liability claims reserve Information

- ($700,000) Technology

The explanation offered is that this was a way to make it appear as if our budget was balanced. As stated by Mr. Johnson, “we have not borrowed it from strangers, but we did borrow it from ourselves… (and) if we do not fund this within five years we will be broke”.

Mayor Tracy, at the conclusion of the presentation stated:

“Based on the way I look on the information we received here tonight we have probably been deceiving ourselves and therefore the general public. There is nothing illegal done here, we did not participate in any conspiracy, but I don’t think it (this) was clear to us”.

—Mike Tracy, Mayor and Retired Chief of Police

He then added that that the Council needed to put more oversight controls in place to prevent this from happening in the future. A new budget will be presented to the Council on May 1, 2013.

Editors Comments

Mayor Tracy and Councilman Heitmann were not on the City Council when these budget “adjustments” were made. For those council members and supporters of the former City Manager, this should be a lesson that the public was deceived and there was not total transparency during Mr. Cole’s administration. To have an interim City Manager, in 6 months time, bring to light that the $12.0M reserve was really $4.3M shows how gullible our leadership has been.

THE NEW CITY MANAGER BUSTS THE BUDGET

Mark Watkins’ higher salary and benefits strain Ventrua’s budget

On March 4, 20013, the City Council met to consider the employment contract for the new City Manager, Mark Watkins. On a vote of 4 to 3 the Council approved the employment contract. He will receive the following salary and benefits plus 6 weeks paid leave:

| Base Salary | $222,000.00 |

| Annual Cost of Living Increases | (1/2% of annual CPI) |

| Annual Performance Bonuses (3%-7%) | $15,540.00 |

| Auto Allowance | $6,000.00 |

| City Contribution to 401(K) | $12,000.00 |

| Employer Pension Pickup (2.5%) | $5,500.00 |

| Total Before Benefits | $261,090.00 |

When invitations for applicants were first published the City Council set the salary rate range of $160,000 to $214,000. The previous City Manager received a salary of $174,000.

The Ventura County Taxpayers Association spoke against approval of the contract because the starting salary was simply too high for an entry level Manager, that the salary should be started lower and then increased to provide performance incentives and the contract provided automatic annual Cost of Living Adjustments (COLA) during the 3 year term of the contract. They also warned against the COLA adjustment because of the precedent it would set when other public union contracts came up for renewal.

Mayor Tracy, Councilman Monahan, Councilwomen Weir and Heitmann approved the contract. They stated that Mr. Watkins was a long time resident of Ventura, that he had worked in the City during his career, that he was an Assistant City Manager in Thousand Oaks and that this was what needed to be paid to attract a qualified City Manager who would focus on the basics of operations of city government. Councilwoman Weir commented that any increase in the salary level could also be justified because “that we have already found savings in the City Manager’s budget to make up the difference”.

Our present acting City Manager commented that Mr. Watkins was a good choice, that this pay increase really only involved “pennies” in the total scheme of things, and that if he did not work out he could just be terminated and given a severance package.

Councilmen Andrews voted against the contract. Councilmen Brennan and Morehouse, after extolling the virtues and accomplishments of the former City Manager, Rick Cole, also voted no.

Editors Comments

Mr. Watkins will cost us an additional 26,102,700 pennies per year. He will earn all of that in dealing with our budgetary issues. We hope that the majority of the Council is right in saying that the additional expense can be justified by the savings that this new Manager will bring to our City.

In the meantime we must be diligent and continue to remind our elected representatives that if they we do not watch how they spend our pennies “we” will have no dollars left.

Editors:

R. Alviani K. Corse T. Cook J. Tingstrom R. McCord S. Doll

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.