Now Is The Time To Appoint A Water Commission

WATER – A PEARL OF GREAT PRICE

[The Right to Protest and Need for a Water Commission]

On March 12th the need for Ventura to create a Water Commission became clear. Ventura City Water/Wastewater Department mailed a notice to property owners advising that effective July 1, 2014, the rates that Venturans will pay for water and wastewater treatment will increase unless a formal written protest (vote) is received by the City Clerk by May 5, 2014. This is the second increase in two years to be followed by increases in 2015, 2016 and 2017.

The notice details what the new rates will be, and in bold type on page 1 announces that a PUBLIC HEARING will be held on May 5, 2014. Specifically it states that “The Ventura City Council welcomes your input during a public hearing to consider the proposed rate increases…”

This notice, in much smaller print, says that “if you wish to protest the proposed charges… you must do so in writing prior to the close of the hearing” on May 5th; and, if not filed in the City Clerk’s office by the date of the hearing on May 5th it will not be considered.

No ballot or rate protest form is provided with the notice. If a property owner wants to protest the increase they have to go to the City web site to download the form, or get the form from the City Clerk. They then must fill out the form and return it to the City. If you don’t have a computer, or are unable to travel to the Clerk’s office, you are out of luck. If you don’t fill out the form correctly you are again out of luck; it will be rejected and considered a “Yes” vote.

In addition to the failure to provide a convenient means to protest, the notice on its face is deceptive. You are advised that that the Council will have a hearing “to consider the proposed rate increase“. Wrong! The council is not going to consider anything about increasing the rates because they have already done that. The only thing they will consider on May 5th is the status of the vote. If the Clerk reports that 51% of the “eligible voters” protested then it fails. If 51% do not protest the increased rates go into effect.

Click on the Protest Button to access the Water Rate Increase Form.

The City Water Department could have easily included the one page RATE PROTEST FORM in the mailer for the convenience of the citizens. They didn’t and the omission speaks loudly.

If you fail to vote “no” by written protest your silence is considered a “yes” vote and acceptance of the increases. This is a rare instance in the California Elections process where doing nothing means yes. If you do not own property then you have no right to vote even though you will be impacted, because such costs will be passed through as price or rent increases.

It is not the purpose of this letter to advocate for or against the water and wastewater rate increases. That is your decision. It is our purpose however to explain the proposition 218 processes and provide a convenient way for you to exercise your right to vote. You will find a copy of the RATE PROTEST FORM here.

BE AWARE OF YOUR RIGHTS

Most people are not even aware of their right to vote. A few are very aware and have gone to the Internet to urge Venturans’ to file a protest vote. One such person had this to say:

“Attached is the form to protest the proposed water rate increases for Jul 1, 2014, July, 1, 2015, Jul 1, 2016 and July 1, 2017. In my opinion every resident getting their water from the Ventura Water Company should be filling out this form and sending it in. A quick review of these proposed rates indicates that they raise my water bill 40% from 2014 through 2017… This time I am protesting these new proposed rates. (Fool me once shame on you, fool me twice shame on me.)

Plus I really don’t think we as subscribers should be saddled with the City’s and the Water Department’s missteps…i.e., the $55 million for the Heal the Bay lawsuit settlement related to the treated water they dump into the Santa Clara estuary, the $630,000 fine for the Water Department not meeting the required ammonia level restrictions for the water they dump into the Santa Clara estuary, the $300,000 they spent pumping water from the estuary into the ocean to lower the estuary water level to alleviate the flooding of McGrath State Park. (Note that as soon as they stopped pumping McGrath flooded once again. Sounds like a plot from a Three Stooges movie)”

Editors’ Comments

We, in our society, are not accustomed to elections being conducted in this fashion. The normal election process is made easy for us. We receive a voter pamphlet that describes the new law, arguments in favor of the law and those against. We then receive our written absentee ballot, or go to a polling place where we are handed a ballot and we cast our vote. This one is different and is not made easy by a City government, which constantly asks for our trust and confidence then goes stupid and does everything to earn our distrust by sending out a notice that is not calculated to fairly and effectively enable the citizenry to vote.

HOW TO OBTAIN NEARLY HALF A BILLION DOLLARS WITHOUT AN AFFIRMATIVE VOTE

A Water Commission prevents Ventura’s City Council from playing fast and loose with Prop 218.

Proposition 218, contained in California Constitution, Article XIII D, section 6, was enacted by the voters in 1996. It says that a City cannot charge a fee for a public utility that exceeds the amount necessary to provide the service – called “the cost of service”. The costs of those services are not considered a tax, but instead it is considered an expense of providing the service.

Tax increases require a 2/3-voter approval. Proposition 218 is different. The City Council must first approve the new rate in a formal hearing and then they “must notify all property owners before imposing the property-related fee”. Not less than 45 days after this notice is mailed, a hearing is to be conducted. If written protests against the new fee are presented by a majority of owners, the fee cannot be charged.

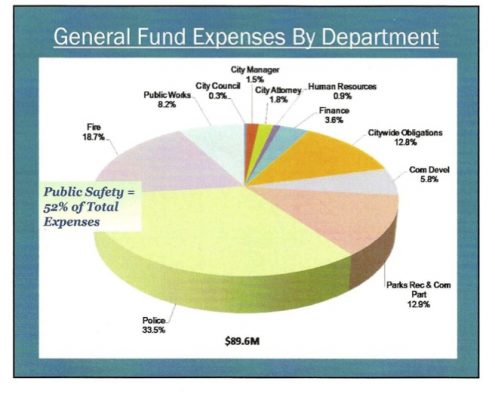

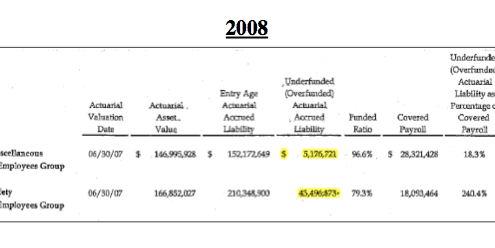

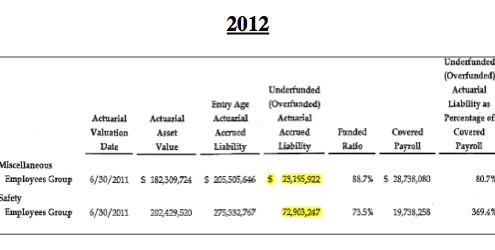

In 2012 and again in 2014 the City Council appointed a Citizens Advisory Committee to totally immerse themselves into the cost of delivering of water and treatment of wastewater throughout Ventura. The Committee was charged with determining the need for increased rates to meet operational costs; water capital improvement projects of $210 million and $231 million for Waste Water capital projects through 2025.

These were formal hearings conducted at the water department offices but were not televised or recorded.

This was a formidable task. Water and Wastewater personnel sought rate increases to build financial reserves so that they could then finance and build projects. The total amount sought for Water and Wastewater capital improvement projects was $441 million.

In the end, the Committee recommended rate increases to the City Council to raise 50% of the cost so that the City of Ventura would be in a strong position to finance the balance of the cost projects over a longer period of time.

Cost to the ratepayers was of real concern. At the same time this Committee was unanimous that we, as a community, had deferred maintenance for far too long. If our community did not address aging water infrastructure, replacement water wells, pumping facilities and water/sewer lines now, the costs of financing such items would be far too great in the future.

MANAGING THE COST OF WATER—TIME TO APPOINT A WATER COMMISSION

Of major concern to this committee was the amount of money that Water and Wastewater was seeking.

$441 million is a lot of money that needed to be managed. Programs were not yet planned. How to manage treated waste water had not been developed. The Committee was confronted with the most difficult task of making informed and reasoned decisions to determine how much money we needed. However it does not end there.

For all of the above discussed reasons, the creation of a Water Commission to monitor Ventura’s water and wastewater is fundamental to the committee recommendation. Unanswered questions and ongoing decisions are still needed in managing this $441 million commitment.

EDITORS’ COMMENTS

The City Council has many constraints on their time and numerous issues that they confront weekly. They do not have the time to effectively monitor and mange a complex public utility involving millions of dollars annually. A permanent CITIZENS WATER COMMISSION is a clear solution.

Such a Commission, in addition to assisting the City Council in meeting their obligations as elected officials, will bring oversight on behalf of rate payers. Appointing former water district managers, engineers, geologists and other professional disciplines, who have the education, experience and knowledge, will serve everyone’s interests.

Editors:

R. Alviani K. Corse T. Cook

J. Tingstrom R. McCord S. Doll

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Fool me once, shame on you. Fool me twice, shame on me.

Fool me once, shame on you. Fool me twice, shame on me.