You Have Reasons To Be Concerned How Ventura Spends Your Tax Money

“Few things are harder to put up with than the annoyance of a good example”—Mark Twain

Complaining about how Ventura spends our tax money is like complaining about the weather. Everyone talks about it, but nobody does anything about it.

When Ventura spends money on projects, you trust and hope city officials would spend it as though it was coming out of their own pockets. However, many believe that City officials view tax revenue as an endless faucet spewing out money.

So, we rely on our elected officials to oversee the expenditures and question them when necessary. The following example illustrates how dysfunctional the oversight has become.

There Is No One Paying Attention To The Details

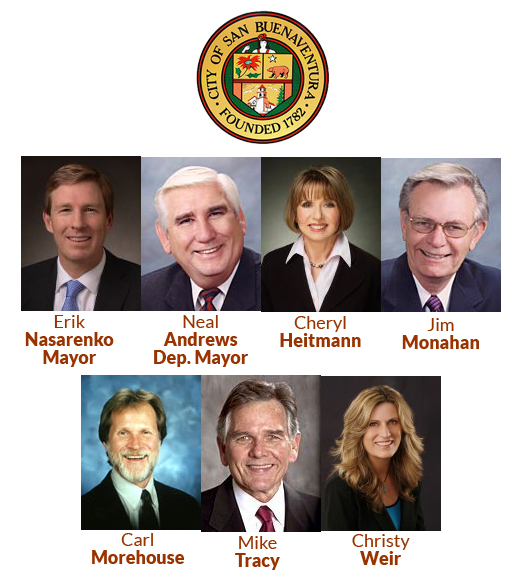

The City of Ventura Finance Committee considered a “small-dollar” expenditure at a recent meeting. Councilmember Christy Weir chairs the committee. Councilmember Cheryl Heitmann is the committee’s vice-chair. Deputy Mayor Neal Andrews also serves. Their job is to provide oversight to the city’s Director of Finance, Gil Garcia, and his staff in the Finance Department. Here is where the dysfunction begins.

The Finance Department wanted to spend $29,600 per year on outsourcing the opening of payment envelopes and processing of water bills. This dollar amount fell within Mr. Garcia’s spending authority and did not need the three City Councilmembers’ approval. He presented the item for discussion nonetheless.

Currently, Ventura Water sends water bills every two months and when payment is made city personnel open the envelopes and process the payments through the bank. The City now wants to send out water bills monthly. Since Ventura will change to monthly billing, the outsourcing costs would double to $59,200.

The city’s finance staff justified outsourcing this service to purportedly to improve cash flow and increase efficiency. The staff did not discuss or offer any evidence on just how they would be more efficient if their proposal were adopted.

Where’s The Oversight?

Only two City Councilmembers attended the committee meeting. Councilwoman Heitmann was absent. Neither Councilwoman Weir nor Councilman Andrews asked how much Ventura would save in real dollars by paying an outside company to perform this task, or how the city would adjust or reduce staffing after the change. The presenters assumed that handling thousands of checks and running them through the city’s bank account apparently would save money and reduce staff time.

A citizen attending the meeting spoke up and asked how much money we would save and how many staff people would be reduced or redeployed. The initial reply was the cost savings would be “minuscule.” When pressed to define what she meant by minuscule, the staff member was unprepared to provide any numbers. When pressed about changes in staffing, the answer was “none.”

Worrisome Questions Arise

That should cause every tax payer in this city to express concerns about the issues surrounding this spending proposal and by extension any plans to spend tax money regardless of the amount:

- Why would any staff member ask for $29,600 per year and not support the request with time and cost savings? If this were a private business, the owner would insist on knowing. Shouldn’t we expect the same of our government?

- Why didn’t the City Council members ask the hard questions about time and cost savings? Their job is to oversee the city finances.

- If the city wasn’t planning to reduce staff, what would these staff people do instead of opening envelopes and processing payments? How would they be more productive in their new duties than they currently are

- If $29,200 is within Mr. Garcia’s spending authority, why wouldn’t he know the cost and productivity savings?

- While this item was within Mr. Garcia’s authorization and did not need to come to the Financed Committees’ attention, it was commendable that he brought the new procedure to the Committee’s attention. However, it also requires having all the available facts to support the decision. Therefore, why was neither Mr. Garcia nor his staff prepared to justify the reason for the change?

After all, with authority comes responsibility. It is not a blind trust. Maybe Ventura needs to review the policy for decisions made within a manager’s authority. All such decisions must be reviewed and supported by documentation.

You may be asking, “Why so focused on one instance such as this?” After all, it’s a small expense. It’s only $29,600 today. But soon, it’s going to double to $59,200. We must remind ourselves of Benjamin Franklin’s admonition — “Watch the pennies, and the dollars will take care of themselves.”

“Watch the pennies, and the dollars will take care of themselves”

In this case $29,600 doubles within the year. No City Councilmember noted or questioned the expense. Why? Is it that our elected City Council members have become complacent? They trust staff recommendations unquestionably? They view this as so trivial it is not worth their time or effort? Or, are they no longer concerned about how they spend our tax dollars?

Editors’ Comment

No matter what the reason is, the City Council has to stop looking at taxpayers as an endless faucet from which money flows. It’s time they started spending our tax money as if it was coming out of their own pockets, not some faceless person.

No matter what the reason is, the City Council has to stop looking at taxpayers as an endless faucet from which money flows. It’s time they started spending our tax money as if it was coming out of their own pockets, not some faceless person.

When the costs in pennies turn to dollars then turn to thousands then turn to millions, and they run short again, who do YOU think they will look to for more money?

Concerned By This? Write A Councilmember.

Click on the photo of a Councilmember to send him or her a direct email.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Fool me once, shame on you. Fool me twice, shame on me.

Fool me once, shame on you. Fool me twice, shame on me.