“No creature smarts so little as a fool. Destroy his fib, or sophistry – in vain! The creature’s at his dirty work again.”—Alexander Pope

911 TAX – POSTMORTEM

[THE GREAT BOONDOGLE. WHERE DID THE MONEY GO?]

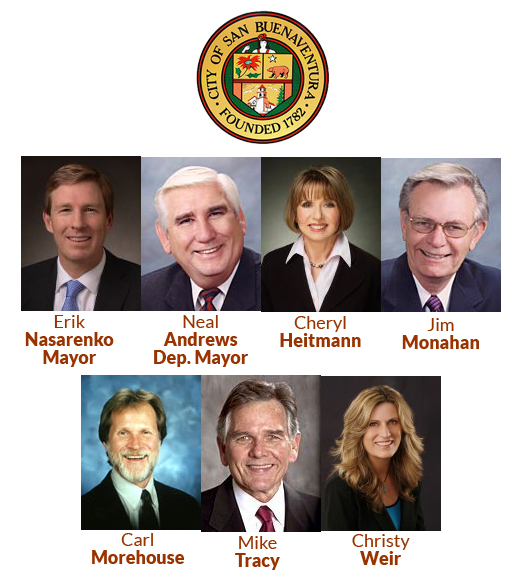

The City Council keeps saying they do not understand why the citizens of this community have such distrust for city government. They are not likely to understand if they are not listening.

Ventura refunded only part of the money collected in the 911 Tax.

No need to again examine the history and the woof of the pathetic effort of the City Council to tax 911 calls, but it does serve to examine the aftermath.

This idea, spawned by our City Manger, Rick Cole, followed on the heals of the defeat of his Measure P6. Of course he has no public exposure and can duck any critics’ comments because he was not elected to office, and did not vote for the tax. Councilmen Monahan, Summers and Brennan, currently up for re-election, however were elected to office, and they did vote for the 911 tax.

Citizens protested, but did so in vain. Lawsuits followed, and only then did the Council take steps to set this all aside to avoid being tagged with a huge bill for attorneys’ fees if they lost. Make no mistake, they were going to lose. It would then be logical, and reasonable, to assume that the money collected under this concocted scheme would be refunded to the people who were FORCED to pay into the program, right? Au contraire!

Citizens left hanging for refund of over $1.2 million from 911 tax.

Our fine City government collected $1,220,005 during FY 08-09, representing 54.2% of the hoped for annual revenue of $2,250,000. Once the law was cancelled you were then offered a refund, if you could prove you paid, only if you had “opted out”, and only then if you attached the necessary documents, and jumped through the required administrative hoops to get your money. Why only if you “opted out”? Because the City Manager surmised that if you did not “opt out”, you must have chosen to “opt in”, meaning that you wanted the city to have this money, and it was your intention for the city to keep the funds all along.

Only $17,096 was refunded. The City kept over a million dollars, used $800,000 to balance the 2008-09 budget and kept $402,909 in the general fund for use this year. Having bilked the citizens of this community, and having failed to refund the money to those who paid, it would seem that at least the Council would have the decency to do the right thing and use the money for its declared purpose – fund the 911 system! That did not happen. Instead the money was stuffed down the proverbial rabbit hole. [okay! used for other expenses like?]

Editors Comment:

Are we hoping in vain that this Council may exhibit some shame, and do the right thing?

THE NEW SALES TAX- “MEASURE A”

[COUNCIL ASKS VOTERS FOR MORE MONEY TO FINANCE FAILED POLICIES]

Ventura politicians are shamelessly asking for more money with Measure A.

It has been clear, since Measure P-6 was defeated at the polls, that this Council would attempt a new sales tax measure. This new measure to raise the city sales tax by ½% was put on the ballot for November, 2009, on a vote of 6 to 1. Councilman Neal Andrews opposed that measure.

In the process of approving Measure A the Council referred constantly to the fact that a “Blue Ribbon Committee”, appointed to consider this proposal, had recommended that a sales tax increase be put on the ballot for public approval, and that the tax be automatically cancelled after 4 years. This was something to behold — that this Council would have our good citizens believe that the Council really needed a Blue Ribbon Committee’s approval in order to place a new tax measure on the November ballot. Members of the Council appointed a majority of the blue committee because they were “friends of the Council” (FOC), so the result was always a foregone conclusion. Former Mayors Jim Friedman and Sandy Smith were on that committee, and each was heard to smirk that they thought “the Council was just trying to seek political cover”.

Now the spinning and fact distortions begin anew. As you are reading you will recall what happened when P6 was proposed. The Council wanted a 1/4% special tax for police and fire. That measure failed, as well as the lawsuit filed by “the City” ( Actually, it was filed by a political action committee headed by Assistant Police Chief Corney, to which each Council member contributed money) against citizens who opposed the tax. They lost that too after paying their Santa Monica lawyers $30,000.

The Council and the City Manager vowed to come back at the citizenry with a new tax. Thus Measure A was put on the ballot seeking double the amount of money sought by P6, but this time as a general tax, which only requires a 50%+1 voter approval. Their hope is that since they received 61.95% of the vote on P6, ergo the voters will approve a ½% general tax increase.

So the rhetoric and distortion begins by the cabal controlling “the City”. To avoid the label of being a “special tax”, requiring a 2/3 vote, the Council decided to promise to spend any new sales taxes in certain ways, but without telling the voters at the same time that they were not obligated to do so [ one could almost see a sly grin and wink from the 6 Council members as this statement was made]. Their promise of how they will spend this $10,000,000 in new sales tax money may prove to be their undoing.

If approved by the voters it will be interesting to see how Measure A survives a legal challenge, and it will be challenged under Proposition 218. That state proposition requires a 2/3 voter approval for any tax devoted to

Police and Fire departments would receive 40% of the money collected from Measure A.

a special purpose as opposed to general tax, which is collected and placed in the general fund. The Council hopes to avoid this problem by saying the funds are “not required” to be used for any specific purpose, yet they announce that the funds will be used for a specific purpose as in inducement to get voters to approve the measure.

Interestingly one of the specific promises made by this Council, as an inducement to voters to approve the measure is that they will spend 40% of the new tax on police and fire — the exact sum they sought to raise in the failed P-6 measure.

Today it’s hard to know what the City is really doing, except that most of the individual Council members are campaigning hard to convince you that you should ignore the waste and spendthrift policies of the past and impose the new tax. They do not want to address the underlying economic malady – overpaid public employee unions and the millions wasted in ill advised decisions like the plan to narrow Victoria, or the ill-fated 911 tax or increasing the fire department retirement programs by 50%. Councilman Fulton, who is also campaigning hard for the incumbents advised one contender that he could not approve of their candidacy because they (the Council ) would lose “consensus” – he really means control. He also stated in a public meeting that we should forget the past and move on. So how, again, was the 911 tax money spent?

Editors’ comments:

Only a fool does not learn from the mistakes of the past.

THE STATE STRIKES

It is now official. Remember that money that you sent in for property taxes, and which is supposed to be returned, in part, to our community? Well our fine state government has decided that to correct their mismanagement and budget deficiencies by taking the money that is supposed to be returned to the cities. Thus our City will not receive $2,760,358 that would be normally returned. We have been forced to loan to a state government that has achieved junk bond status in the market place.

The money is not gone, just delayed in delivery. Of course the State promises to pay this back in 3 years. How about interest? The answer we get is that this will be set by someone and sometime in the future — you know the line — “trust us”.

It gets worse. In addition to the loss to the general fund, the Redevelopment agency has lost $1.2 million, and that will never be repaid. It is gone. Makes you wonder if Ventura had spent some more Redevelopment agency funds in the last 2-3 years, whether there would have been any funds to raid?

CITY COUNCIL USES A SMOKESCREEN

[NEVER LET A GOOD CRISIS GO TO WASTE]

This City Council again has to scramble to adjust their budget to allow for this loss. The hyperbole and spin from City Hall, and the proponents of this tax is that we really need the new sales tax because they have adjusted the budget as much as they can, employees have taken a 5% pay reduction and our State Government has taken our money. What is a poor City Council to do? Long before the state did its most recent raid on City funds the die had been cast. The ½% sales tax was already in the plan. The City Council members are campaigning hard for the new tax as if the problem is all due to the State and they had some great insight – in short playing the fear game as a reason for the voters to approve the new tax.

Opponents point out that such a tax is regressive, that business has never prospered in such in an environment, that even though there is a 4-year sunset provision the Council proposes to use the new tax money to make long term commitments to police and fire (40% of the new tax money), and that when the 4-year period is up the Council will go back to the voters arguing that if we do not extend the tax there will be cuts in services — you know the old saw — crime, untimely emergency responses to medical emergencies, etc. The opponents also point to the spendthrift policies of this council over the last 6 years, for example $1,000,000 alone was spent to narrow Victoria Avenue. That should be money in the bank, but instead is sitting in the pockets of City employees and Los Angeles consultants. There are $13,000,000 of such expenditures, which should be in the bank, but is not because of unrealistic planning and spending by a liberal out of touch Council.

Mayor Weir is campaigning for the new tax and has stated publicly “we will not spend any money we don’t have”.

Editors’ Comments:

We hope each citizen will reflect on whether the past should matter in deciding how to vote.

Editors:

B. Alviani S. Doll J.Tingstrom

K. Corse B.McCord T. Cook

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.