Pension Redux

“Stupidity is also a gift of God but one mustn’t misuse it.”

—Pope John Paul II

PENSION OBLIGATIONS REVISITED

On March 11th the City Council was informed that the $12 million reserve that we have had since 1992 isn’t available as we had been led to believe. Although the General Fund has about $28 million, including this $12 million dollar reserve, by the end of the 2012-13 fiscal year had been “committed” or “promised” to someone or something. This includes such things as a $5.4 million dollar loan to the Ventura Redevelopment Agency or the $2.4 million set aside for the Jobs Investment Fund.

These promises are in fact liabilities, money we that we owe. If all of the promises are fulfilled and the RDA successor agency is unable to pay back their loan, the General Fund would only have $4.3 million. Not discussed or mentioned at this Council meeting were the other debts and liabilities, in particular the unfunded public pension debts. Those obligations have increased 97.4%. since our report to you 4 years ago.

The Comprehensive Annual Financial Report (CAFR) is an annual financial report detailing the financial condition of our City.

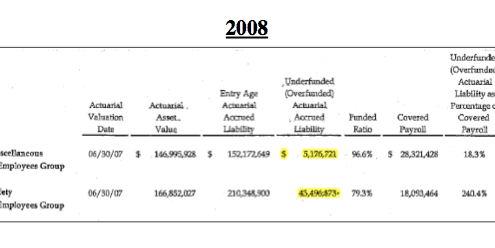

We start with the Comprehensive Annual Financial Report (CAFR). This is an annual financial report detailing the financial condition of our City. These numbers are accurate, but bear in mind that by the time we see the reports the data is 18 months after the fact. Further, you have to look in the footnotes to discover those debts which are “off the books” like the City pension program, which is administered by CALPERS.

What follows is an extract from the 2008 CAFR, as it related to the status of the City pension plan then. The third column reflected how much we owed to employees and retired employees as of the date of the report. The category of “safety” covers police and fire pensions and all other employees are carried in the “Miscellaneous Employees group”. Our unfunded liability totaled $48,673,594.

In the same year the revenue collected by the general fund totaled $88.7 million, of which $47.1 million (53.1%) was spent exclusively on police and fire departments. The percentage of our general budget paid to police and fire has increased dramatically whereas other employee costs have remained relatively stable. In 2009 59.9% of our total budget was allocated to public safety, 57.7% in 2010 and 53% in 2011. That did not include the “unfunded pension obligations”.

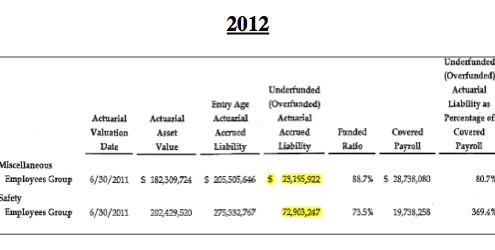

In 4 years UNFUNDED PENSION OBLIGATIONS INCREASED 97.4% and now total $96,099,169.00.

These unfunded obligations accrued interest year after year, at the rate of 7.75%. CALPERS did not recover the substantial losses (reported by some news sources as 50% )as a result of the 2008 recession. They also did not earn the 7.75% annual projected investment returns until just recently. On the Legislative side efforts at the State and local level to move from a defined benefit plan to a 401(k) plan for new hires failed. Our City did try to address the problem by requiring current employees to contribute 4% of their compensation toward their own retirement plan, but it was piteously short. In 4 years UNFUNDED OBLIGATIONS INCREASED 97.4% and now total $96,099,169.00.

CALPERS is quick to point out that over a 20 year period the” return for each fiscal year ranged from -24% to +21.7%., and if we let them continue to manage our pension plan they “assume” we will get a return of 7.50%. But, if we want out and want to run our own program they use a 4.82% rate of return. We really owe $350,848,292. (See attached Hypothetical Termination liability for each plan).

PUBLIC PENSIONS OR BOND HOLDERS – AT RISK

[WHAT IS GOOD FOR THE GOOSE IS GOOD FOR THE GANDER]

Last year the Governor’s office and legislature announced that they had achieved “pension reform”. The reality is that they did not change any of the current pension benefits. They did this mainly for political reasons, but also because it is widely assumed that employees in the public pension system are protected by the constitutional ban on “impairing the obligations of contracts”.

Public employee unions have stridently asserted that they are different and thus bullet proof. This attitude was displayed clearly when the City of Stockton filed bankruptcy. That City told their bond holders and/or their insurers to take less, but refused to reduce the $29 million it pays each year to CALPERS for the employee benefits.

Assured Guaranty Ltd, which insured the Stockton bonds, stood to lose $100 million. They filed a complaint in the bankruptcy court claiming that Stockton had targeted the bondholders to take a loss, but continued to pay CALPERS without any reduction or did not seek any benefit reductions from the public labor unions.

Another insurer, National Public Finance, added their voice to the controversy, supported the Assured Guaranty position, but also alleged that the City of Stockton “rather than face the hard realities imposed by its unbearable liability to CALPERS (decided) to take a pass” – in short, that it was easier to sacrifice the bond holders than face the political wrath of the public employees or CALPERS.

So, the bond insurers asked the bankruptcy judge, Christopher Klein, to declare the City’s bankruptcy plan as inadequate because it ignores the pension debt, and they seek to compel the City to reduce its pension payments. The CALPERS reaction was to argue to Judge Klein that the pension payments have a higher priority over bonds. CALPERS lost.

In December, 2012, Judge Klein rejected the CALPERS constitutional inviolability of contract argument and ruled:

“While a state cannot make a law impairing the obligations of contract, Congress can…the goal of the bankruptcy code is adjusting the debtor-creditor relationship. Every discharge impairs contracts”.

So, what will happen to the benefits of the public pension contracts or the bond holders? CALPERS, those in the Stockton pension plan and the bond holders may both lose. This chapter is soon to be written.

EDITORS’ COMMENTS:

A 97.4% increase in unfunded liabilities over a 4 year period is setting Ventura up for failure. Most citizens don’t realize that Ventura will pay $13.3 million to CALPERS for 2012-2013. This is over and above salaries and other benefits. As more employees choose to retire early (50-60 years of age) this only gets worse.

Call it what you will, but the City Council thus far has adopted a profligate fiscal plan of doing nothing to pay this unfunded obligation. Hoping that the economy will rev up, that inflation will chip away at the obligation, or that somehow our pension assets will produce magnificent returns is foolish.

When the Council considers its new budget in June we urge them to set aside a percentage of our annual revenue to add to our reserve and/or apply to the unfunded pension obligations, and to release some of the commitments it has made to the General fund cash balance.

Editors:

B. Alviani K. Corse T. Cook

J. Tingstrom R. McCord S. Doll

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.