How To Make The Most Powerful Job In Ventura Government More Accountable.

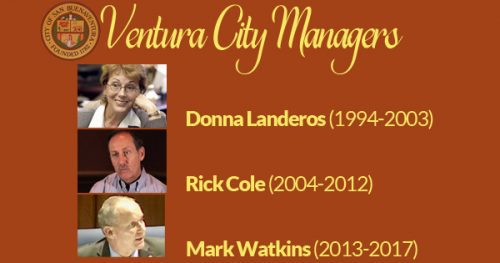

Here we go again. Ventura is hiring its fourth City Manager since 2000.

You’ve undoubtedly told our children or grandchildren, “Haste makes waste.” It’s sound advice; especially when you want to prevent them from making a mistake. The same advice holds true for Ventura’s City Council when hiring our next City Manager. A hasty decision now leads to adverse consequences in the future.

The City Manager is the most powerful role in Ventura’s city government. He controls millions of dollars and impacts Ventura for years to come. He does this with little oversight by a part-time City Council. And history shows the Council lacks sound financial judgment when overseeing him. Voters know even less about how the City Manager does his job.

A Chance For The Council To Start Fresh

This City Council faces its most important decision—selecting the next City Manager. It’s no easy task. The new manager will be responsible for healing Ventura after the Thomas Fire. No prior City Manager has faced such a daunting task.

The Council should act slowly, boldly and thoughtfully when hiring. They should think creatively and progressively as they make their selection.

Balancing these goals will not be easy. The Council will feel internal and external pressure to act quickly. They’ll want to fill the vacant position right away to provide leadership at City Hall. And, citizens will demand someone to manage the Thomas Fire recovery. The search firm Ventura hired will add to the external pressure, too. Ventura pays the search firm when the new City Manager accepts the job. Typically, the fee is three months of the City Manager’s starting salary. In this case, it’s $60,500. The search firm will want the City Council to act quickly, so it gets paid.

The Council must resist the urge to succumb to the pressure.

We Know Poor Choices Lead To Financial Disaster

The tenure of the past three city managers keeps getting shorter.

The City Council does a poor job overseeing the City Manager. Former City Manager Rick Cole moved $7.5 million from the Public Liability Fund, Workers’ Compensation Fund and Information Technology Fund to other areas in the budget to make it appear as if the city’s budget was balanced. Either the Council didn’t catch the manipulation or was unwilling to investigate further.

A city manager could confuse the city council in the past.

Former City Manager Donna Landeros reallocated $9 million earmarked for the proposed Convention Center for various city programs, and nobody knows what happened to the money.

And, most recently, retiring City Manager Mark Watkins acted as the chief cheerleader on Measure O. He touted the money was for city services when the truth is it will eventually go towards employees’ pensions.

Even the City Council’s most recent hiring decision costs taxpayers money. The Council erred in the transition to Mark Watkins from Rick Cole. Cole received total salary and benefits of $189,341 along with a housing allowance to move to the city. When Watkins came in, he didn’t need a housing allowance because he already lived in Ventura. Rather than save that money, the Council chose to increase his salary and bonus to $242,059. The $52,718 increase impacts the city’s future financial condition negatively. At the time, Councilmember Christy Weir claimed hiring Mr. Watkins would save the city more money than the rise in his salary. The figures don’t bear that out over the four years he served in the role.

What’s more, Mr. Watkins is to receive his retirement pension based on his highest salary. At 56 years old, Watkins will receive retirement pension based on his $242,059 salary.

Greater Transparency Is The Key

Past City Managers had a bureaucratic background. Some argue requiring bureaucratic experience makes sense. Bureaucrats are the antithesis of transparent, though. They operate out of sight of the voters. This lack of transparency was disastrous for Ventura. Here’s why.

The city manager would be more accountable with published standards of performance.

A bureaucrat measures success by how large a team he manages. He’s driven to increase budgets to protect that organization. A more massive government usually equates to increased regulation. Rarely is that beneficial to citizens.

Also, a bureaucrat that is friendly towards and advocates for the city staff is not impartial. He will be reluctant to reduce expenses, eliminate unnecessary work, redirect work to private entities or minimize long-term staff costs. Bloated staff costs taxpayers money.

Finally, a bureaucrat negotiates his retirement when negotiating for the staff because he participates in the same plan. Human nature being what it is, the City Manager will likely bargain less vigorously, creating a conflict of interest.

Transparency begins with knowing how the City Manager is performing. The city should use Standards of Performance (SOPs) to measure achievement. Currently, the City Manager doesn’t have SOPs listed on its website. The Council should prepare SOPs, and the city should post them for the public to review. What’s more, the City Manager’s accomplishments should be in the public record. Citizens deserve a yardstick to measure if the city is meeting the City Council’s directives.

How to be more transparent when selecting the next City Manager:

- Publish the screening criteria the City Council gave to the search firm to select candidates

- Reevaluate the job qualifications and look outside of municipal government.

- Post the Standards of Performance. Establish measurable performance levels on a regular review schedule.

- Establish a Blue-ribbon committee to provide the Council strict salary and bonus guidelines.

- Verify a candidate’s financial management expertise. The candidate must provide clear and incontrovertible evidence.

- Insist on community outreach success from the candidates. The job description doesn’t list this as one of the primary duties.

Editors’ Comments

Hiring the next City Manager is paramount, and citizen input is a must.

Tell The City Council Not To Act Hastily

Below you’ll find the photos of our current City Council. Click on any Councilmember’s photo and you’ll open your email program ready to write directly to that Councilmember.

Let them know what you’re thinking. Tell them what they’re doing right and what they could improve upon. Share your opinion. Not participating in government makes us worse because our city government isn’t working for all of us.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.